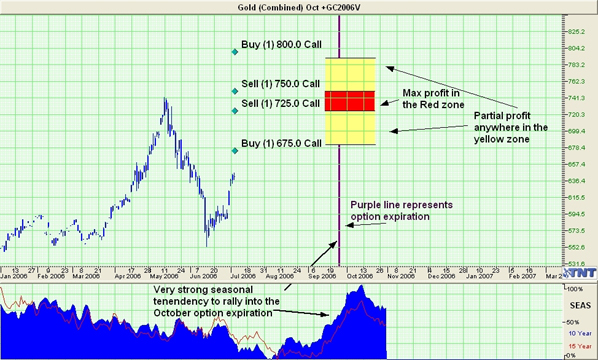

- Market: October 2006 Gold (GCV6)

- Tick value: 1 point = $10

- Option Expiration: 09/26/06

- Trade Description: Bull call ladder spread

- Max Risk: $750

- Max Profit: $4250

- Risk Reward ratio 5:1

Buy one October 2006 Gold 675 call, also buy one October Gold 800 call, while selling one October Gold 725 call, and sell one October Gold 750 call. For a combined cost and risk of 75 points ($750) or less to open a position.

Technical / Fundamental Explanation

Gold has been on a wild ride ever since breaking out above $500. We saw a brief but fast rally that carried us to about $740 earlier in the year. Since that rally we have seen quite a dramatic sell off followed recently by the current bounce. I believe the current bounce will carry us back towards $700 and ultimately test the highs made earlier this spring. First of all we have a very pronounced seasonal tendency to rally into the October option expiration as I noted on the chart below. Second we are at a time when geopolitical uncertainties are at unprecedented levels. Every day we turn on the news it is something else, one day Korea, the next is Iran, who can forget Irag, to say nothing of Afghanistan or Gaza. I am not trying to be an alarmist but with so many things out there that could spin even more out of control, having a defensive trade on via gold only makes sense. This trade was designed to risk a minimum amount for a medium term bull trade in Gold. We have a huge range of $110 on the price of Gold that we can profit in and a $25 range within that where we achieve maximum profit so this trade really gives you ample opportunity to profit from a resumption of the bull run in gold.

Profit Goal

Max profit assuming a 75 point fill is 425 points ($4250) giving this trade more than a 5:1 risk reward ratio. Max profit occurs at expiration with Gold trading between 725 and 750. The trade is profitable at expiration if Gold is trading any where between 682.50 and 792.50 (break-even points) which means we have a band of $110 in the price of Gold that we can profit in

Risk Analysis

Max risk assuming a 75 point fill is $750. This occurs at expiration with the Gold trading below 675 or above 800.

Derek Frey is Head Trader at Odom & Frey Futures & Options.

Disclaimer

Past performance is not indicative of future results. Trading futures and options is not suitable for everyone. There is a substantial risk of loss in trading futures and options.