This article was originally published in Stock Futures and Options magazine.

Stock option traders have always been faced with the additional work of not only correctly predicting the underlying security's price, but then also choosing the appropriate option strategy. But most stock traders mistakenly figure they can easily make the transition from stocks to options. As easy as falling off a log, right? Maybe not. There are differences that traders need to keep in mind when making the transition to options.

Stocks Don't Expire. Options Do. Plan Accordingly.

In order to make money in options on an ongoing basis, a trader needs to understand the major difference between stock and option trading and that is the impact of time on stock and option positions. With stocks, time is a trader's ally, as the stocks of quality companies tend to rise over longer periods of time. However, with options buying, time is his "enemy." As each day passes without any significant change, there is a decline in the value of the time premium. To top it off, the value of the time premium declines more rapidly as the option approaches expiration.

The important factor that option traders should assess is the amount of time that is expected for a move in the stock to take place. Buying near a stock's low may be helpful as a strategy, but if the trader has to wait too long in an options position, the loss of time could more than overwhelm a moderate gain in the underlying stock. Given the accelerated impact of time decay the closer the options are to expiration, option buyers would be well advised to buy more time before expiration than will be needed. Having at least one month before expiration to spare when the position must be closed out is preferable. This allows the option buyer to avoid the especially painful time decay, which occurs in the final month before expiration.

On the other hand, the option seller seeks to benefit from the time decay that occurs most rapidly in the final month. As a consequence, the expiration month chosen for sellers should be aligned to reach expiration in conjunction with the time that the expected holding period is reached.

The Most Important Statistics for Option Traders to Watch

In addition to knowing the expected holding period, option traders should be aware of the percentage of profitable trades they expect to generate, as well as the size of the average profitable trade compared to the average losing trade. By multiplying these two statistics, an option trader can get a sense for the advantage gained compared to an average system.

An average system could be assumed to occur with random selection, such as a coin flip, in which 50 percent of all outcomes are winners, and the size of the average winner and loser is the same, amounting to a 1.00 ratio. As a result, this random combination yields a product of 0.50 (50-percent profitable times 1.00).

If you develop a system with 75 percent of trades profitable, and a 2.00 ratio of average win/average loss, you would have a product of 1.50 (0.75 X 2.00) , amounting to a 3-to-1 edge versus the random model. A 3-to-1 edge could also be created by a 30-percent profitable and a 5.00 ratio of average win/average loss. The higher the profitable percentage, the less the average winner has to outdistance the average loser.

By the same token, a high ratio of average win/average loss means the trader still can have a meaningful edge with a relatively low winning percentage. It is this 3-to-1 edge or higher that we seek when creating equity trading systems, as it has resulted in systems that can work well for option trading since the magnitude of the edge is substantial. This substantial edge allows factors like slippage (the difference between a system's price and the ultimate execution price) to be incorporated, with a meaningful edge remaining.

A couple of caveats. First, these statistics are most relevant with a meaningful number of samples. Twenty trades are preferred in a system to deem these performance statistics significant. So, make sure the method is well tested. With fewer trades, one large losing trade can downwardly bias the average win/average loss figure if it is the only loser, even if all of the other trades are winners. In addition, commissions must be factored in to the testing to closely simulate real-world results.

Finally, realize that the "slippage" (difference between the trader's paper-trading tests and his real-world entries and exits) on options systems are magnified due to the leverage of options relative to stocks. The more contracts the trader is trying to get filled, the greater the slippage will be on momentum-based systems. My models often prefer to spot breakouts in the underlying stocks and then acquire the options on re-tests of these stocks' support or resistance lines, to minimize slippage and liquidity issues.

Options Traders: Focus on Volatility or Trend?

Most options analysts will tell traders to focus on the volatility assumption within the options pricing model, as that is the only factor the standard options model assumes to be unknown. The stock price is assumed to be basically unchanged, except for a carrying cost equivalent to the short-term interest rate. This assumption is due to the Efficient Market Theory notion that stock prices incorporate all available information and cannot be predicted into the future. We believe, however, that trends occur and can be predicted and, thus, this options pricing model assumption creates a good opportunity for option traders.

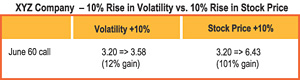

First, focus on the expected movement in the underlying stock's price, as the average off-the-floor option trader gets a much bigger impact from a given percentage gain in the stock than from the same percentage change in the volatility assumption. Let's look at the example of an XYZ Company June 60 call option with approximately 10 weeks until expiration:

As you can see, the 10-percent gain in the stock price amounts to a 101-percent gain in the option price, while the 10-percent jump in volatility leads to a 12-percent gain in the option price. If these events are equally probable, then the trader has about an eight-to-one edge in focusing on the stock price change relative to the volatility change. Looked at another way, the 10-percent change in volatility would have to occur eight times for every one time the stock price changed by 10 percent for there to be no edge in focusing on expected stock price over volatility.

While floor traders and big institutions may get a great deal of value out of monitoring daily changes in volatility, most individual option traders will find much more value in focusing on expected stock price. And, the bigger the expected trend, the bigger the trader's edge versus the standard option pricing assumptions.

Determining the Best Option Strategy: You Have a Choice

Many times traders are way too optimistic in the scenarios they input, and a way to moderate this is by employing one of the following two tactics: Traders wanting to use more conservative tactics can either 1) buy one strike further in-the-money or 2) buy the next expiration month further out than they think they'll need.

Option traders, or any traders or investors, for that matter, will always be faced with being wrong no matter what they do: if the position is a winner, they feel like they should have bought twice as much or, if the position loses, they feel as if they should never have bought it. This is human nature, of course. While a trader can always second-guess himself, he will be better positioned over many trades by taking a more conservative approach to mitigate those situations that could knock him out of the game entirely as opposed to worrying that some profits have been left on the table by choosing a less leveraged option.

As a result, I tend to encourage option traders to prefer in-the-money options, which derive their name from the fact that there is already some part of the option that has intrinsic value.

For example, if XYZ stock is at 53, the September 50-strike call trading at 5 will have 3 points of intrinsic value (the current stock price of 53 minus the right to buy at 50), also known as being 3 points "in-the-money." The remaining 2 points of the option's premium are known as the "time value." If the stock stays stuck at 53 at expiration, these 2 points of time value would be lost, but the 3 points of intrinsic value would remain intact. So the "in-the-money" option trader gains more stability by trading an option with some element of intrinsic value.

Stock traders would be wise to spend a little time looking at some of these idiosyncrasies before they assume that they can make the switch from stocks to options in a flash. Are they tough? No. But do they present a few challenges? By all means. Options hold a great deal of potential, but they are different investment animals than stocks. Don't forget it.

Price Headley is the founder and chief analyst of BigTrends.com.