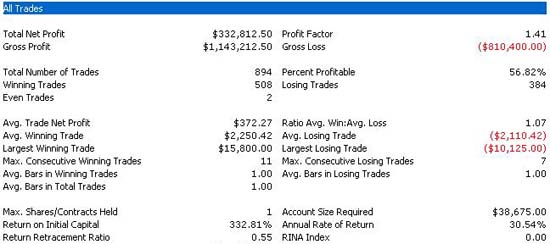

As always, whether we're right, wrong or in-between, there is at least historical evidence behind our decisions. Yesterday we began posting daily composites of eight indicators. Figure 1 shows why this idea excites us in the full-sized S&P 500 contract. Note that the $372 profit per trade is well in excess of the standard $100 per trade slippage/commission debit.

Figure 1: S&P 500 Futures Contract

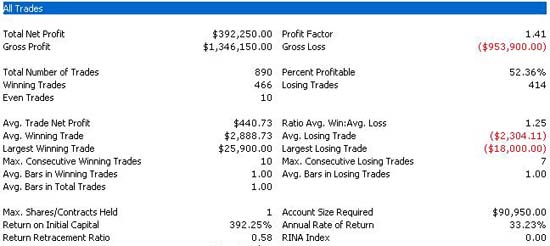

You can see similar results in the Nasdaq futures contract.

Figure 2: Nasdaq Futures Contract

Figure 3 shows that the bias persists across all our targeted markets. This represents a five-year history through May 30, 2005. Certainly there are plenty of trials to fortify us. The returns on accounts are respectable at worst and quite encouraging at best.

Figure 3: Nine Futures Markets

Again, this is intended to be a trading aid, although there are different implications to how it could be a stand-alone system. (Trading the three indexes as-is could certainly be one valid possibility.) You'll be able to see not only the overall buy-sell bias, but the actual number of indicators pointing each way. That is, the strength of the combined signal. Tomorrow we'll show how the results change when you act only on signals with strength-weaknesses of at least +/-3.

Daily CzarChart for June 21

The bottom row provides the direction of the bias at the open: long (L) or short (S). When it's neutral, it will read zero (0). Click here for a more in-depth explanation of the rules.

Dynamic Monthly Biases for June 21

This is the last day for the monthly down indicator. All dailies are neutral‚Ä"therefore hold existing shorts in the Nasdaq and Russell. Flip from long to short in the mini S&Ps.

The bottom two rows determine the signal. Dynamic Day One trumps everything‚Ä"you always follow it. When it's neutral, the Monthly Perpetual provides the direction. Click here for a more in-depth explanation of the rules.

DISCLAIMER: It should not be assumed that the methods, techniques, or indicators presented on in this column will be profitable or that they will not result in losses. Past results are not necessarily indicative of future results. Examples presented on this column are for educational purposes only. These set-ups are not solicitations of any order to buy or sell. The author, Tiger Shark Publishing LLC, and all affiliates assume no responsibility for your trading results. There is a high degree of risk in trading.

Art Collins will be speaking at the Chicago Trader's Expo on Saturday, July 16, from 8:00 to 9:30 a.m. The presentation is Identifying, Combining and Profiting from Daily Biases in the Futures Markets. E-mail Art at artcollins@ameritech.net.