How has another year come and gone so quickly? It seems like someone hit the fast forward button. And once again, all too soon, it is time for me to demonstrate my masochistic nature and write a forecast issue. Rather than going into details on every topic, I will try and stick to the big picture and leave the fine points for later letters.

Each year as I do this forecast, I look for a theme. What will be the driving factor which will set the stage for the economy? In 2001 it was the coming recession; in 2002 it was a weak recovery and the beginning of the Muddle Through Economy; in 2003 it was Surprise and Transition. In 2004 it was the Silver Lining Economy; in 2005 it was the See-Saw Economy. Last year it was The Gripping Hand, as Bernanke had the economy in his interest rate gripping hand. Who knew in January 2006 how far he would go?

This year the theme is The Goldilocks Recession. As outlined in the past few months, I think the US will have a mild recession or slowdown in 2007. That premise leads to a lot of other follow-on forecasts. Why the theme? Remember that after finding things were just right, Goldilocks ended running out of the house when the bears came home. And I think the housing bear will finally come home in 2007.

And as I do each year, we start by reviewing last year's forecast. Prior to last year, I had been on kind of a roll in my forecast issues. Never perfect of course, but all in all I have been lucky. I wrote as a preface last year:

"As I look at the coming year, I think it is likely I will not be as successful in my accuracy. There are a lot of potential variables which could cause any number of my predictions to be wrong. But chief of my concerns is Fed policy. When will they stop raising rates? In my mind, I see Ben Bernanke playing Clint Eastwood, doing the Dirty Harry role, looking into the face of the housing market and saying, 'Do you feel lucky punk? Well, do you?' As we will see, this is the wild card upon which the economy will turn."

As it turns out, I did not do all that badly. I wrote at length why I though the Fed would go further hiking rates than the consensus at that time and I was right. However, I thought that raising rates more than most economists thought, plus a slowing economy, would put a damper on the stock market and I was really wrong in calling for a down year in the stock market. I also thought inflation would peak earlier than it has, but that is my bias, as I think that global deflationary forces will eventually be the order of the day.

On the plus side, I got the currency markets right. I was mildly bearish on the dollar as well as seeing a small rise in the Chinese Renminbi. I was bullish on gold and energy. I did not think we would go into a recession in 2006, but that consumer spending would slow down by the end of 2006. I predicted a return of the Muddle Through Economy by the end of the year, which we certainly saw. Growth in the last half of the year will be below the 2% range, which qualifies for Muddle Through. I was positive on global growth and China in particular, even with many calling for a hard landing in China. I also called for a correction in copper, which we surely got this year.

Past performance is not indicative of future results. In golf, you drive for show and you putt for dough. Forecasts are for show. I can guarantee I will get a few things wrong. Maybe a lot of them. Count on it. Its how we invest, and what either confirms or changes those forecasts as time plays out that is the key. If the facts change, so will my views. However, a forecast stays forever in the archives, good or bad. Let's see if we can get a few right this year.

Caveat: If I am wrong about the housing market retreat causing a recession, this forecast is going to be really wrong.

And speaking of the accuracy of forecasts, a note from reader Nathan Lewis called to my attention an interesting historical event. Let's get in the Way Back Machine and go to the 70s. The Dow had topped out in late 1965 - early 1996, and then began an almost 30% bear market drop to the spring of 1970. But wait, from that bottom the Dow took off. In January of 1973, the Dow topped out around 1050, or 5% above its previous high. Writes Nathan:

"On January 1, 1973, Barron's published its famous Roundtable interviews with big-name professional investors. The title was 'Not a Bear Among Them.' (By the way, the Fed Funds Rate, as of the end of December 1972, was -- 5.33%! You can't make this stuff up.)"

Of course, the Dow then proceeded to drop 40%.

The Goldilocks Recession

Economic forecasts this year tend to fall into three camps. The very large majority which sees a mild slowdown (not a recession!) with the Fed cutting rates in response and then renewed growth. They look back to the middle 90's where there was indeed a slowdown but not a recession, and the market continued to climb. Goldilocks, indeed.

There are a few which see the roots of a serious recession based upon a collapse in housing prices and a manufacturing slump.

And then there is the lonely middle where I reside, which sees a mild recession (at least by historical standards). It's like the line from the one hit wonder by Stealers Wheel from 1973:

"Clowns to the left of me, jokers to the right of me, stuck in the middle with you. And I'm wondering what it is I should do."

Why just a mild recession? Because basically the bulls are right about 70-80% of the economy. Things are doing just fine, thank you. The service sector is rocking along with the latest ISM number for the service sector at 57.1%, which is quite healthy. By some estimates, the service sector is up to 80% of the economy.

There is not a recession in health services. Where is the bear market in government employees? Education? Except for mortgage related services, there is growth in the finance area. Technology? Food services? Every month, we see solid increases in service employment. Unemployment is a comfortably low 4.5%, with many areas of the US showing even lower levels.

The problem is in two areas, housing (which is categorized mostly as service) and manufacturing, especially auto related manufacturing. These sectors are in recession already. If you are in the home building business, it feels like more than a recession. While some point to a small rise in new home sales, there is plenty of evidence to suggest that it is from aggressive price cutting. Even so, the numbers of new homes for sale just keep rising.

Under normal circumstances the bulls would be right. A slowdown in the housing sector, even a serious one, should not be enough in and of itself to cause a recession. But this is not a normal circumstance.

1. We have had a real asset bubble in housing. Bubbles do not end without pain.

2. US home owners have used the rise in the value of their homes as a source for increased consumer spending through Mortgage Equity Withdrawals (Mews), financing increased consumer spending even while savings were negative. MEWs are going to fall even more as home prices do not rise and even (hard to believe!) fall.

3. The housing industry -construction, finance, sales, MEWs, furniture and renovations - accounted for a significant part of the recent growth there has been in the economy. Without that positive contribution, and indeed what will be a negative detraction in 2007, the economy will indeed be slower.

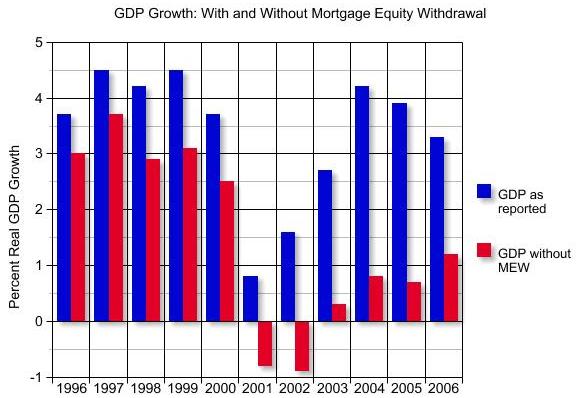

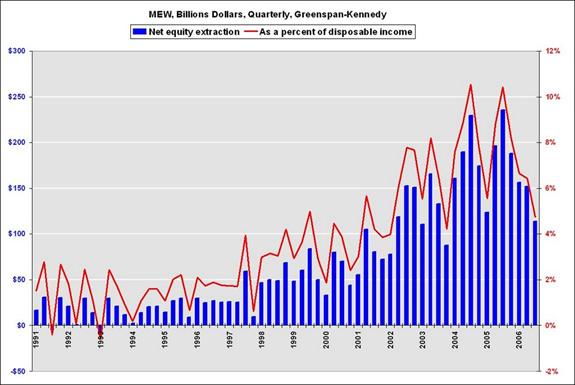

Let's review two charts from friend Barry Ritholtz we used last week. The first is what GDP would have been without MEWs.

The second graph shows the drop in MEWs through the third quarter. As we will see below, home prices are not going to be rising, thus making it more difficult for home owners to borrow money against the rise in their home values. Given other pressures mentioned below, I think it is enough to cause consumer spending to slow enough to cause a recession.

That Hissing Sound You Hear

In my home counties (Dallas and Fort Worth, Texas) homes are very affordable when compared to the rest of the nation. We have not experienced the bubble.

Yet, foreclosures are at an all-time high here. There is a flood of these homes coming onto the market. The pattern is the same all over the country. Why should foreclosures be high in a period of low unemployment? Part of it is that bad stuff happens to good people. They fall behind, lose a job, get sick. Any of a dozen reasons.

But it is also because the mortgage industry has made some very bad loans. That hissing sound you hear are the subprime mortgage loans escaping from the housing bubble. The Center for Responsible Housing suggests that loose lending practices in 2005 and 2006 will push 20% of the sub-prime loans made into foreclosure. This is not insignificant. Subprime loans are 25% of the mortgage market. What do you think will happen if 20% of recent sales go back onto the market?

And that is based on a mere 3.6% drop in housing prices nationwide. If the price drops are more typical of what we have seen in regional housing recessions (we have not seen a national one since the Depression), housing prices could drop more than 3.6%, pushing more homes into the problem zone.

Gary Shilling writes: "Subprime mortgage loans have also leaped in recent years as a portion of total originations, and among subprime mortgages, so have ARMs. Most of those Subprime borrowers are very stretched to meet monthly mortgage payments, and few have financial resources to fall back on if they lose their jobs or if their mortgage payments adjust up substantially. They already spend about 40% of their incomes on house costs. But payments will leap unless interest rates collapse-- and soon.

Around 60% of subprime ARMs issued since 2004 have fixed interest rates for two years and float for 28 years thereafter--2/28 mortgages. Their original rates in 2004 were 7.1% on average and, under their mortgage contracts, can eventually adjust up to about six percentage points over the current short-term benchmark, the London Interbank Offered Rate (LIBOR). It's 5.4% at present, so those subprime ARMs can adjust to 11.4% if market rates don't change. Wow!

"On average, those subprime ARMs' upward adjustment is limited to 2.3 percentage points on the first reset and 1.2 points per year thereafter. So a subprime ARM originated in 2004 adjusted to 9.4% last year, and will move to 10.6% in 2007 and 11.4% in 2008 if benchmark rates remain the same. This is known in the trade as reset shock for good reason. Of the estimated $436 billion in mortgage loans that reset last year, $250 billion were subprime as are $360 billion of the $585 billion that will move to floating status in 2007."

The Derivative Sleeper

Lenders are going to become more cautious for several reasons. First, as these bad loans come home to roost, there will be losses. Regulators are increasingly mandating higher standards. Finally, investors are going to balk at buying the paper. This latter may be more of a sleeper than most people realize.

Derivatives known as credit default swaps are getting expensive if you want the protection. And there is a hidden problem in the mortgage market. The credit rating agencies have priced some derivatives based on past performance that may in fact not be justified when the future rolls around.

First, before we get into the subject of mortgage derivatives, let me say the sky is not falling. We are not going to see a meltdown of the global financial system. But there are going to be some people who are going to lose more money than they had planned for, because they are taking more risk than they thought there were.

Let's say a large investment bank puts together a pool of subprime mortgages. They break this pool up into various "tranches." The first tranche gets the first money back and gets a justifiable AAA rating. This is about 80% of the pool. Lower tranches take more risk as they are lower down in the repayment stream. They slice and dice these pools down to where some tranches are rated C, somewhere slightly above Enron debt.

About 4% of the pool is rated BBB, or barely investment grade. Now, here is where it gets interesting. Let's read what Shilling has to say about this debt paper.

"...Next the BBB tranche, only 4% of the RMBS [Residential Mortgage Backed Security], is pulled out and combined with BBB tranches from other pools to serve as collateral for a derivative called a Collateralized Debt Obligation. Since this combining of BBB tranches supposedly creates diversification that the rating firms' models indicate will drastically limit delinquencies and defaults, the AAA tranche of the CDO is 75% of the total capital structure and 12% is rated AA. Only 4% is considered BBB. So pools of mortgages that probably would be considered below BBB are miraculously turned into a CDO with 87% of its capital structure rated AAA and AA and only 4% is rated BBB.

"Wow! Talk about a sow's ear being turned into a silk purse! Think of the leverage involved in converting low into high quality debt, even more so when the CDOs are leveraged by their buyers 10 or 20 times! And think of the losses when the 25% fall in house prices we foresee wipes out the whole BBB tranches of the RMBSs by which the entire CDOs are collateralized!

"Conversely, consider the potential huge profits of investors that are essentially buying insurance policies, Credit Default Swaps, that pay out any losses on BBB tranches of the CDOs. But will the sellers of these CDSs be able to make good on their contracts if the house price collapse we foresee materializes?"

Who buys this stuff? Gary suggests that a lot of it is Asian and European institutions who simply look at the rating by the credit agencies and buy. It is also sophisticated shops that buy default insurance when they buy the CDOs, as well as high risk funds that have investors who are searching for yield.

Remember Amaranth, the hedge fund that blew up $6 billion of investor money this year? Not a hiccup in the market. We are going to see some of these CDO pools "have issues." Some are simply going to disappear. Investors will lose some of their assets.

And let me say again the sky is not falling. The vast majority of mortgage paper will be just fine, thank you very much. A few investors losing a billion here or there is not a problem for the system as a whole.

What will really be the upshot is that investors are eventually going to shy away from the subprime market without increased protection, scrutiny and returns. The day of the no paperwork subprime mortgage will go away not because of government action, but because the market will simply not take the paper.

Why should we care? 25% of the mortgage market is in the subprime space. If a significant portion of people (which would be way less than the 20% mentioned above) who have bought homes on subprime mortgages are foreclosed on, and there is not financing for a new buyer for that home, it goes on the market and the price drops until it becomes affordable to a sub-prime buyer under the new tighter standards.

Every real estate agent knows that it is first time home buyers who are in large part the fuel for the market, buying from more established households who are "moving on up to the Eastside."

Problems on the Margins

Now, let me be clear here. I am talking about problems on the margin. The vast majority of subprime loans are going to be repaid on time, as are their more conventional cousins. Remember, 80% of the country, and a large portion of the rest of homeowners will be just fine. They may not be happy because their piggy bank doesn't automatically refill with home prices rising 15% a year, but they will adjust.

But recessions are all about "on the margin." Really all a recession is is a period of time when the economy does not grow but falls back, usually just a few percentage points or on the margin. Recessions are typically created when a small portion of the economy has larger than usual problems. In the past, it has classically been manufacturing, but manufacturing is an increasingly smaller part of the US economy. This time it will be the housing market and its cousins that put pressure on the consumer.

The housing problems will spill over into consumer spending, both from much lower MEWs and from the negative wealth effect. Throw in higher mortgage payments for a significant portion of the country and there is less to spend. Instead of robust growth in consumer spending, we will see anemic growth in much of 2007. Note I said growth.

But with inflation at 2%, businesses need 2% growth in consumer spending just to "break even." While we all talk about "real" or after-inflation GDP, we live in a nominal GDP world. Yes, incomes are (finally!) going up, but they have to go up enough to cover the rise in expenses and to cover the loss of MEWs, etc. I don't think they will.

From a sector standpoint, I think it is consumer durables that get hit the hardest in the Goldilocks recession. Consumers will buy the staples. The simple bear necessities will be ok, but larger purchases will be put off.

Timing? Aah, now you ask a much harder question. The inverted yield curve historically suggests no sooner than the second quarter and by at least the end of the third quarter, but what does a yield curve know? That sounds as good a time frame as any.

But won't the Fed start to lower rates? Yes, but I think it unlikely that it will be in time. The Fed has made very clear, and the minutes from the meeting on December 12 underscore their unease, that inflation is still a concern. They are not going to lower rates until the inflation monster is well and truly dead. Not unless they want to lose their credibility, and they seem to value that.

Today's employment report suggests that a Fed ready to cut rates is further off than the market hopes.

Will the Stock Market (Finally!) Be Ready to Correct in 2007?

If I am forecasting a recession, then that suggests the stock market will drop as well. Maybe not by as much as in past recessions, but it is hard to see how it could shrug off a recession without so much as a real correction of at least 10-20%. In future letters we will look at why a deep (the 40% plus that is typical in recession) stock market bear is not as likely.

It also follows then that the Fed will cut rates and that long term interest rates will go down, thus there is some room for a bond rally. Let me suggest you go to www.pimco.com and read Bill Gross's latest missive. He argues that nominal GDP is too low for the current rate structure. (Van Hoisington and Lacy Hunt do as well, for different reasons. I will send you their latest letter in Monday's Outside the Box).

Let's jump to Gross's conclusions:

"We at PIMCO look for a Fed Funds rate of 4 1/4% by December of 2007 with 5 and 10 year yields hovering at levels perhaps 25 basis points higher. While that by no means would be reflective of past bond bull markets in terms of magnitude, that is not to imply that 12/31/07 would mark its last gasp. With nominal growth in the U.S. economy dependent on asset appreciation more than ever before, the Fed will lower rates as far as they must in order to produce it. We, like everyone else, will be interested observers along that downward path as they attempt to push the nominal economy back to the magic 5% rate of growth necessary to pay this nation's bills. Is the Fed impotent now? Not as powerful as it once was, but with private financial market participants more interested in other pursuits, it may be the only game in town, at least for 2007, and if it lowers rates sometime within the next six months then the U.S. bond bull market will gain renewed vigor."

Hard to argue with the Bond King. But while he does not say so, if the Fed is having to cut rates that much that would suggest to me that a serious slowdown, if not a recession, is underway.

A recession means that risks premiums should reassert themselves into the high yield bond market, so if you are reaching for yield, I would be very careful. Very careful indeed.

And if the Fed is cutting rates while Europe is raising theirs, as their economy seems to be on a better track, then you would expect the dollar to fall some more. Nothing precipitous, just another leg down, especially against Asian currencies.

But in a mercantilist world, I don't think that many countries will let their currencies rise all that much against the dollar. So, no large returns without leverage, but that means a lot of risk. If you are going to invest in foreign currencies with any type of leverage, let the professionals do it for you. There is no guarantee, but the leveraged currency markets (futures and other derivatives) is no place for amateurs. And even the pros get spanked regularly.

And if the dollar will fall some more, you would have to think that gold will rise, so I remain bullish on the barbarous relic. The energy complex? A pause is in order before the next leg up as foreign demand just keeps rising. And just as last year, I would still be wary of long only commodity funds, at least for the first part of the year. That could change.

If we do get a mild recession and a correction in the stock market back to lower than trend valuations, I expect to finally turn selectively bullish on stocks. I am really looking forward to that.

I think the global economy will get a mild hangover from a US recession, but not as much of one as in the 90s. Things are changing.

The risks to my forecast? One very real one is typified by Steve Leuthold, a very seasoned (and generally right on target) analyst, who thinks the recession does not start until 2008. I am often early on these things.

Another real possibility is that there is not even a slowdown, as many think will be the case. It could happen. If inflation does indeed come down faster than it now looks, allowing the Fed to cut rates not as stimulus but because inflation is not a problem, then we could indeed find that soft landing. If that is the case, then take every forecast I made (except energy) and turn it around.

Or the economy could get strong, stoking the inflation fires and force the Fed to raise rates. I don't think so, but credible economists, ones that I respect, see that as a possibility.

That being said, for all the reasons I haven outlined in this letter over the past few months - the inverted yield curve, the leading economic indicators, a housing recession, pressure on the consumer and more - I think we see the Goldilocks Recession in 2007. We will see. Stay tuned.

John Mauldin is president of Millennium Wave Advisors, LLC, a registered investment advisor. Contact John at John@FrontlineThoughts.com.

Disclaimer

John Mauldin is president of Millennium Wave Advisors, LLC, a registered investment advisor. All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors before making any investment decisions.