Thursday we had seven Stocks to Watch and three Around the Horn subscription trades on our screens. Of these, seven hit for profits, two were scratch trades to the upside, and one was no-show.

Energizer Holdings (ENR) was a Fast Ball long on the Stocks to Watch list that broke up off the open. This one was good through mid-day when the bunny lost its vigor and began to fade, crossing below the 8- and 20-simple moving averages and below recent support.

Energizer Holdings

General Growth Properties (GPP) was a Stocks to Watch Line Drive long Tuesday, Fastball Wednesday, and we were looking for continuation again today. We weren√Ę‚,¨‚"Ęt disappointed. GPP hit off the open and traded sharply to a high of 56.26 before trailing down. An exit at a cross of the 8-period simple moving average and confirmation with a violation of the Parabolic SAR (support and resistance) signaled the exit.

General Growth Properties

Alliant Techsystems (ATK) was a subscriber Around the Horn Fastball setup. Entry was at 79.70 with a 79.37 stop and an initial profit target of 80.36. ATK hit off the open and traded straight to R1 before pulling back to just above the .382 Fib level at the 50% to target. Using this as a profit stop, the trade was alive to the initial target and beyond. Peeling some shares off at this level is one strategy for larger share sizes, but the result was the same, with the profit stop at or just below support at the initial profit target of 80.36.

Alliant Techsystems

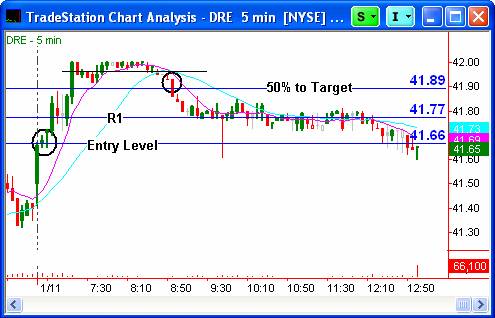

Duke Realty (DRE) was a subscriber Around the Horn Fastball setup. Entry was at 41.66 with a 41.29 stop and an initial profit target of 42.13. DRE hit off the open and traded through R1 to a consolidation above the 50% to target level. When DRE did not trade higher, but rather broke to the downside, a profit stop was triggered at the 50% to target level.

Duke Realty

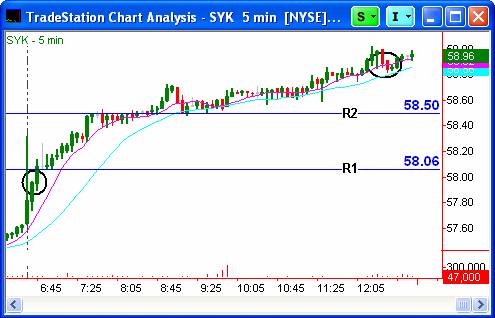

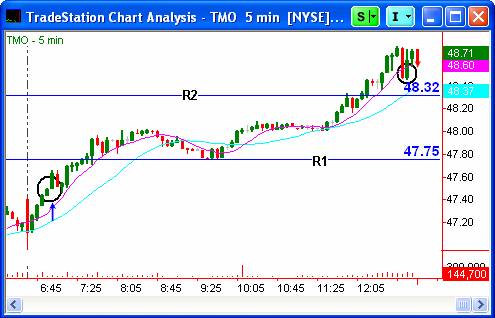

Public Storage (PSA), Stryker Corp (SYK) and Thermo Fisher Scientific (TMO) all hit as long entries off the open with no sign of triggering their Sinker short entry levels. Without an immediate reversal, we looked at these as Fastball long possibities, and they did us proud.

Public Storage

Stryker Corp

Thermo Fisher Scientific

Extra Innings for Friday:

From Thursday√Ę‚,¨‚"Ęs Stocks to Watch, COO may make its move to the long side and WWY could still make its move to the short side. CI could also fulfill Monday√Ę‚,¨‚"Ęs Switch Hitter long now that it√Ę‚,¨‚"Ęs hit above its 20-day simple moving average.

P.S. Join me and a dozen professional traders in the TraderInsight.com War Room. Click here for your free two-week membership.

Julie Peterson-Manz is cofounder of TraderInsight.com. Email her at Julie@peterson-manz-trading.net.