I got a lot of mail as usual from readers about my annual forecast. It was about evenly divided between those who think I am too much of an optimist and those who think the economy will avoid a recession. There are a number of readers who think we have already seen the bottom, and that 2007 will be a banner growth year.

Let me be clear about one thing. My call for a mild recession/slowdown stems almost entirely from my thought that housing is going to be a real problem in the coming quarters. This will cause a slowdown in Mortgage Equity Withdrawals and put pressure on consumer spending. It will cause a rise in unemployment, which is also bad for consumer spending. If the housing market does not slow down a lot more than it already has, then my forecast is going to be wrong. It is as simple as that.

And as is typical of changes in the economy, there are a lot of mixed signals. Certainly the rather solid December consumer spending number we got today does not suggest there is much pressure on the US consumer. Retail sales account for almost half of all consumer spending, which in turn makes up more than two-thirds of gross domestic product. Today's government report provides a broader picture than industry figures, which showed a disappointing holiday shopping season.

Same-store sales rose an anemic 3.1% for December on an annual basis. But those figures are only 17% of retail sales. The government data shows consumers were busy elsewhere, either at restaurants, the internet, or buying health care, among a lot of places besides the mall to spend your money.

And certainly the stock market sees no problem, with another record close today for the Dow. On a technical basis, there are a lot of reasons to suggest this market may go higher in the short term. So if your forward looking view is six days or a month, you may have reason to be optimistic. If you are looking at a longer time period, and/or agree with me that a recession/slowdown is in our future, then the stock market may indeed pose more of a challenge.

Declining Commodity Prices Signify Weakening Economy

I am not the only analyst expecting a recession, of course. I ran across this note from those smart guys at Comstock Partners (www.comstockfunds.com). It will give us a nice segue into some thoughts on the volatility in commodity prices and speculation about the price of oil. Quoting:

"The idea that falling crude oil prices will boost the economy and overcome the plunge in housing is yet another instance of hope replacing reality. Despite its great importance, oil is just another commodity that goes up and down with the business cycle. When the economy begins to weaken commodity prices go down; when the economy is strong commodity prices go up.

"Since its May high the CRB commodity index has dropped 22%, only the 7th time this has happened since 1974. According to ISI, since 1974 every decline in the index of 20% or more has been associated with either a recession, a significant slowdown or a financial crisis. Each of these periods has also occurred following a period of tight money and an inverted yield curve. In this regard it is also noteworthy that oil has not been the only commodity declining in price. Recent months have featured significant declines in a wide assortment of commodities such as copper, gold, sugar, hogs, wheat and corn. It is therefore likely that the oil price decline is itself a result of economic softening rather than an impetus to growth.

"ISI also points out a number of other factors historically associated with significant economic slowdowns including the lagged effect of 17 rate hikes; the decline of house prices; the plunge in mortgage equity withdrawals (MEW); the inverted yield curve; significant slowing in the leading indicators; tightening by foreign central banks; and nominal GDP growth under the fed funds rate. [All factors I have written about in the past few months - JM]

"In addition our own studies indicate that a serious economic slowdown in the period ahead is more likely to end in recession rather than a soft landing. Not only have soft landings been extremely rare in U.S. financial history, but expansionary cycles featuring a series of fed rate hikes, an inverted yield curve and a sharp drop in the growth rate of the leading indicators have almost always been followed by a recession and bear market. Note that the soft landing in 1995 was not associated with an inverted yield curve or a 20% drop in commodity prices, while the soft landing in 1985 was not preceded by a series of fed tightening moves. Every recession starts out looking like a soft landing in the period of transition between economic expansion and contraction that we are probably in today. In the current instance the unusual housing boom and subsequent collapse make the prospects for recession seem even more likely."

Some Thoughts on the Volatility in Commodities Or Sell! Mortimer. Sell!

One of my favorite movies of all time is Trading Places. It is Dan Akroyd and Eddie Murphy at their best. But one of the great lines comes from Don Ameche and Ralph Bellamy, who play the two older brothers Randolph and Mortimer Duke, respectively. As the world of orange juice prices go against them, Don Ameche turns to Bellamy and yells, "Sell! Mortimer. Sell!" But there was no one on the other side to buy, and they went bankrupt.

And who can forget the cameo scene in Murphy's Coming to America where he gave a sack of cash to two skid row bums, who turn out to be the Dukes. They leap up shouting "We're back in business!" Such is the mentality of traders.

Commodity traders in the various trading pits can be forgiven if they see that as not funny this week. Commodity prices are jumping around dramatically. Various commentators have suggested that it is because the central banks of the world are pressuring the various lending banks which provide leverage to funds and traders to cut back.

I made some calls this week and can find no evidence of anything like that, nor can anyone else. What you can find is that some lenders are cutting back on their exposure due to the volatility in the markets, and that is normal and what you would expect. Plus, some traders have gotten caught the wrong way on expected changes in the long-only commodity indexes.

Dennis Gartman was telling me it is like the wheat exchange market last September. Normally, the wheat pit traders build up large positions to make up to $0.01 per bushel during the rollover periods from one quarter to the next as the funds based on the Goldman commodity index roll over their positions. Dennis says it was not unusual for a trader to build positions of 5,000,000 bushels. Not a bad living if you can get it. Except that the rollover was not as large as expected and the spread went from the normal one cent to a dollar, and half the floor was significantly damaged. Again, they were yelling "Sell!" but there was no one to buy. Many of the wheat traders had been there for decades and in a few days were gone. It was very sad.

It is too early to say, but we may be seeing another version of the wheat problems, but in a lot of other markets. Both the Dow Jones AIG and the Goldman indexes changed the weighting of the various commodities in their respective indexes, and in some cases significantly. There was some anticipation by the market of this, but again, it appears that many traders just got it wrong and the prices jumped all over the place. No conspiracy. Just bad timing. (I should note that some traders got it really right. The differential betweens winners and loser this month may be exceptionally wide.)

By Tuesday the rebalancing should be complete and the markets will be more "normal." And that begs the question, as I get asked a lot by readers, as to what the normal price of oil should be.

Should Oil be $40 or $80 a Barrel?

Will oil drop to $40? Or go back to $70? Or $80?

There are no easy answers to this question, but let's see if we can frame some of the issues. First, demand is going to increase over time as an energy-hungry developing world needs more and more energy. Take a look at this chart from the Bank Credit Analyst showing the percentage of global oil consumption that comes from China and India. It is going from the lower left to the upper right, and only slowed down during the slowdown in global growth around 2001 (a point we will come back to later).

Crude prices closed today at roughly $53, down considerably from the $77 of recent memory. Prices are down 10% over the last month. Why? Inventories are high and the northern hemisphere is having an unusually warm winter.

OPEC has cut their production and will likely cut again, as they would like to maintain prices closer to $60. The problem is that OPEC members cheat. It is one of the few reliable factors in the oil business. Much of the actual burden of production cuts falls on the shoulders of Saudi Arabia. They have done the work so far, but will it be enough? There is reason to think they might let oil prices drop even further in the near term. And here, I want to highlight some fascinating research by Ben Dell and his team at Bernstein Research.

Today, there are about 2.5 million barrels of spare production capacity (excluding Iraq, Nigeria, and Venezuela), with almost all of it controlled by OPEC. If OPEC actually cut production as they say they will, they could indeed work through the high inventories and take the price back up to over $60. By the way, excess capacity is on target to rise to 4 million barrels a day in 2008, even with solid growth of 1.8% in world demand. There is a lot of new production coming online.

The problem for OPEC, however, is that most OPEC members will cheat. Will Saudi Arabia be willing to cut enough to make up for their cheating partners? So far, they have. But it looks like they will have to make further deep cuts in production, to 8 million barrels a day, which is below levels not seen since 1991 or the aftermath of 9/11 in 2001.

But they have said they intend to increase their production capacity to 12.5 million barrels per day by the end of the decade from 10 million barrels presently. They are in fact spending the money to increase their capacity, and significant new capacity will come online this year and next.

Bernstein concludes: "The dilemma facing Saudi continues to grow. While cutting back incremental heavy barrels when crude prices were $75/bbl was relatively painless, the country is now facing the prospect of having to drop below 8Mbpd to keep the market balanced. At the same time, Saudi Aramco is undertaking one of the biggest investment programs over the last 20 years, as evidenced by the soaring rig count and multiple field reactivations. Of these, the AFK field is the first to come online in 3Q/4Q 2007 for 500kbpd and 1Bcfd.

"Should Saudi decide to hold back volumes to maintain prices, their proven capacity utilization would probably need to drop to 75-77%, which has historically been a threshold level. While this may sustain pricing for others it would of course lower Saudi's market share, given that few other OPEC members seem inclined to assist. Furthermore, it would continue to stimulate the oversupply in the market, hence prolonging the problem. Evidence of any countries 'cheating' on their production cuts may emerge soon with the IEA and OPEC January reports, which will be published later this month, or through February when the new quota system comes in, and will highlight the extent of the compliance within the OPEC group.

"In reality we think this is not a path that makes sense to Saudi in the long term. A sharp correction in crude prices (and especially futures prices), spurring new demand and delaying non-OPEC capacity expansions would generate short term pain but longer term gain. At the same time, the Saudis would regain control of the market while negating the Iranian threat to their leadership in the region. As always this remains something of a guessing game. However, it appears that there is only so low Saudi will go. Based on history, we are months from reaching that threshold.

"Given the weakening fundamentals of growing spare capacity, moderating demand, the high expectations for the peer group and the weakening gas market, it appears challenging to see 2007 as a year of outperformance."

And thus the dilemma for investors. You can't really trot out a supply demand chart for 2007 and draw any real conclusions about price. Yes, sometime next decade demand may indeed start to bump up against supply, but the price of oil today is as much political as it is supply and demand.

If Saudi Arabia decides that the rest of OPEC is not doing its fair share of cuts, it could simply allow the price of oil to drop to $40 for a short period of time, causing some real pain. The fact that it would hurt Iran as much or more is probably not lost in the inner chambers of Riyadh. At $40 oil, Iran does not have the spare cash it needs, let alone has promised. It could make the current regime a lot more shaky.

A drastic drop in oil prices would let everyone in OPEC know they need to get with the program, also stop a lot of new oil projects around the world and stimulate demand (as lower prices always do). To get all of that to happen might be worth a little fall in cash flow for a few months or quarters. And when their new capacity comes online as world demand grows, the rest of OPEC goes along with production quotas to maintain higher prices. As world demand grows, and prices rise, Saudi pockets even more vast sums of money. And they let Iran know who holds the real power.

Thus, there is no "normal" price for oil. It is still what a few men with willpower sitting around a table decide it is. Ultimately, OPEC will lose that power, as world demand grows past supply, but that is not this decade. At that point, the market will set price.

Of course, the price of oil could shoot up with a collapse in Nigeria, as rebels are becoming increasingly active. Or Iraq or any number of unstable regions that produce oil could have problems.

The Predictive Power of Oil Prices

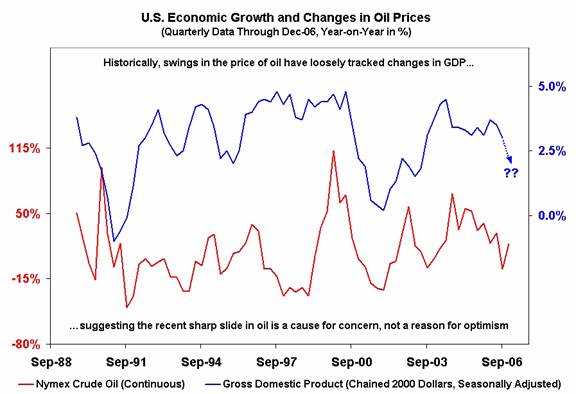

In the interesting chart of the week category, Michael Panzner sent along this graph, showing how the change in the price of oil relates to GDP growth. There is some correlation. Remember that we noted above that Saudi production dropped in economically slower times? Part of the drop may in fact be due to slower global growth. (http://www.stockmarketjungle.com)

Reverse Immigration

I travel the world and am constantly amazed at the number of immigrants from all countries who have relocated to various ports of call. One report from the BBC suggest that 10% of Britons now live somewhere besides England. http://news.bbc.co.uk/2/shared/spl/hi/in_depth/brits_abroad/html/default.stm

This week, I was sent a summary of a series of surveys conducted by New Global Initiatives out of Bethesda, Maryland (www.ngiweb.com). They have been studying reverse immigration, that is, the number of people who plan to move from the United States to another country. Given that less than 1 in 10 of my fellow countrymen even has a passport, I was actually surprised at the number of people who plan to move outside the US.

I am going to do a longer report on this study and immigration at some point in the future, but let's end this letter with a few highlights. NGI commissioned Zogby (a very respected outfit) to ask US citizens whether or not they intended to move out of the US at some point in the future. Nearly 1% said yes, and 3% said they intended to buy a home outside the US. At an average of $260,000 a home, that would be $1.7 trillion, by the way.

Not to mention the boost to local economies from all the spending. As an example, while there are no reliable statistics on the number of Americans in Mexico, it is likely there are at least 600,000, giving a significant boost to the Mexican economy. It is not all just about illegal immigrants.

But it is not just retirees. The survey shows that the age groups most interested in moving are younger, generally under 34. And depending on the question, the younger groupings are 3-4 times more likely to be interested in foreign climes than my generation.

This is one of the reasons my friends at International Living are seeing their subscriptions rise. You can subscribe if you like, and see what is attracting such attention.

The world is getting smaller. In another 10-15 years, with the faster and significantly improved communications that are coming, where you live and work is going to be as dependent on where you want to live and what you want to do as where you were born. When you can sit in your living room or office, watching your 60 or 70 (or 100!) inch TV, and see your friends, family, and business associates sitting in their living rooms or offices, in real time and in high-quality, high-definition, it will change how we live. It will not be the small-screen, jerky pictures of today. It will be closer to life-size with the ability to really communicate.

Reverse immigration is more of an issue than you might think. If a significant portion of American citizens (or British or French or ...) decide to leave, then they are going to need to be replaced in the workforce by incoming workers; or GDP growth, productivity, tax receipts, etc. will all fall. US policy should start to think about how we are going to attract more foreign workers and not be focused on putting up barriers.

Japan is now starting to see its population decline, as of last year. It will not be too many decades before there are twice as many people over 60 as there are workers. That does not bode well for the world's second most prosperous nation.

Japan is starting to think about changing its defense policy. They need to start thinking about who will be in that army of the future. Who will man the shops and factories and hospitals and needed services?

The same with Russia. It is one thing for Putin, et al, to want to see a return of Russian power. It is another thing to try and staff an army with a dwindling population and the youth of the country leaving. By some accounts, Russian population could drop by 30% in the first half of this century.

This is one of the great and hidden waves of change that will affect everything that we do, as well as the political interactions of countries. The ability to attract young, willing workers is going to be one of the hallmarks of a successful nation in the coming decades.

John Mauldin is president of Millennium Wave Advisors, LLC, a registered investment advisor. Contact John at John@FrontlineThoughts.com.

Disclaimer

John Mauldin is president of Millennium Wave Advisors, LLC, a registered investment advisor. All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors before making any investment decisions.