Tuesday we had five trades from the Stocks to Watch column, two Around the Horn subscription trades and two Extra Innings on our watch list. Of these, three hit for profits, one was a scratch trade and five were no-shows.

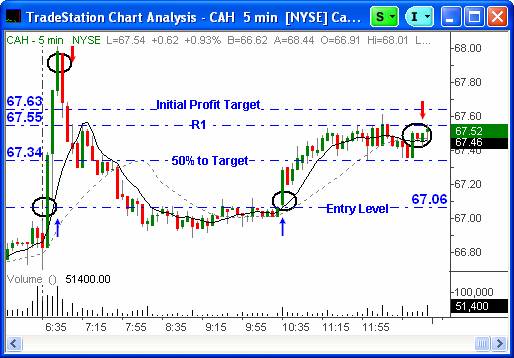

Cardinal Health (CAH) was a Fastball long off of Tuesday’s Around the Horn subscription trade setups that followed through as anticipated. CAH hit off the open and traded quickly past the initial profit target to a high of 68.01. The exit was on a breakdown of the consolidation on the 25 tick chart when CAH failed to break to the upside. A second entry opportunity presented itself later in the day, climbing past the 50% to target and consolidating above this level. Exit here was end of day at a failure to break through the R1 level.

Cardinal Health, Five Minute Chart

Cardinal Health, 25 Tick Chart, First Half-Hour

Alaska Air (ALK) was a Backdoor Slider from Tuesday’s Stocks to Watch column and was a turbulent ride today, but with at least two profit opportunities. ALK opened above our price and settled into yesterday’s highs before trading up and hitting our entry level. ALK traded to a high of 44.52 before reversing. An exit at the break of R2 protected profits. A second opportunity presented itself later in the morning, but was a bumpy ride until end of day, with an exit either as it broke down through R2 or at end of day.

Alaska Air

Coach Inc (COH) was setup as Backdoor Slider continuation or Sinker from Tuesday’s Stocks to Watch column. COH was gapped higher in the morning and continued to a high of 47.03 before dropping off. Entry was on the break to the downside, with an exit after a double play and cross of both R2 and the 8-period simple moving average.

Coach Inc, Five Minute Chart

Coach Inc, 25 Tick Chart, First Hour

Extra Innings for Wednesday, January 17th:

We will keep an eye on DRS, TMO & GCI for potential follow-through to the downside. SYK may now follow-through long on last Thursday’s Fastball move, but as this has been setup as a Sinker (Fastball at 52-week highs on Thursday) and an Infield Fly on Friday (both reversal patterns) be aware of its pullback potential as well.

P.S. Join me and a dozen professional traders in the TraderInsight.com War Room. Click here for your free two-week membership.

Julie Peterson-Manz is cofounder of TraderInsight.com. Email her at Julie@peterson-manz-trading.net.