Thursday we had six Stocks to Watch, three subscription Around the Horn setups and one Extra Inning. Of these, two hit for profits, one hit for a loss, two were scratch trades and four were no-shows.

Ann Taylor Stores (ANN) was a short on Thursday’s Stocks to Watch list. ANN hit our entry price mid-day and spent some more time consolidating at that level. The breakdown was in the last hour or so, with an exit end of day.

Ann Taylor Stores

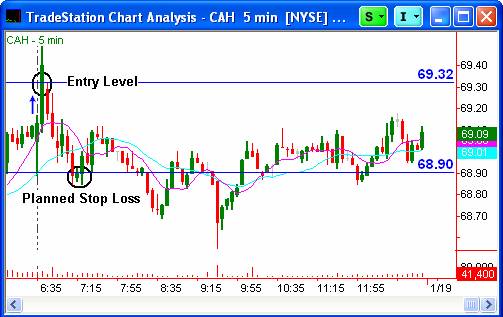

Cardinal Health (CAH) was a Fastball long on Thursdays Around the Horn subscription service. CAH triggered the entry off the open, only to take us out at our planned stop loss within the first hour.

Cardinal Health

Goodrich Corp (GR) was a short on Thursday’s Stocks to Watch list. A more aggressive entry was triggered shortly off the open, and a more conservative entry was triggered a dime or so below yesterday’s low. Either way the trade was slow and steady until the last hour, when GR consolidated and reversed over the 8-period simple moving average.

Goodrich Corp

Extra Innings for Friday, January 19th:

Stryker (SYK) made a run up today from the bottom to the top of its recent consolidation under daily resistance. Tomorrow we will look for follow through to the upside.

Cemex (CX) did not follow through with its Fastball setup today, so we will watch for a long continuation on strength.

UST, Inc. (UST) found support today, and we’ll be looking for short action if it can break through this level.

Federal National Mortgage (FNM) ended up as a scratched trade today, making it to the 50% range to the profit target on the subscription service before turning around and triggering the breakeven stop. Tomorrow we will look for follow through on weakness.

P.S. Join me and a dozen professional traders in the TraderInsight.com War Room. Click here for your free two-week membership.

Julie Peterson-Manz is cofounder of TraderInsight.com. Email her at Julie@peterson-manz-trading.net.