| Around the Horn: Nightly Review |

| By Julie Peterson-Manz |

Published

01/25/2007

|

Stocks

|

Unrated

|

|

|

|

Around the Horn: Nightly Review

Thursday we had five Stocks to Watch, five Around the Horn subscription trades, three Extra Innings and three Baltimore Chops on our radar.

Mobile Telesystems (MBT) was an Infield Fly, Around the Horn subscription trade from Thursday’s setups. MBT hit our short entry off the open and quickly traded down through S1 to the initial profit target and beyond before trading back up to these levels. The exit could have executed in a couple of ways. If the trade had enough shares to pair off Ã,½ at or below the initial profit target (1) then Ã,½ would be left to trail with a stop at 50% to target (54.43). Otherwise, all shares could exit at this level (1). MBT consolidated for much of the day before taking another plunge down. If trailing shares, this half took the ride (2). If out entirely, then seconded entry could have been taken at this time (2). Either way, exit was end of day.

Mobile Telesystems

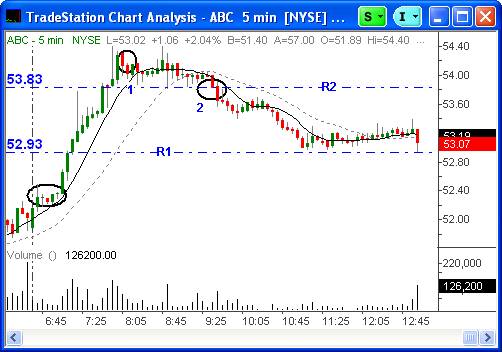

AmeriSource Bergen (ABC) was a Line Drive from Thursday’s Stocks to Watch column. ABC hit off the open and traded smoothly up through R1 and R2 pivots to a high of 54.40. Exit was off this high (1) with either Ã,½ shares for larger trades or all shares for smaller trades. If 1/2, then the trail was at R2, and the exit for these shares turned out to be here (2).

AmeriSource Bergen

Allegheny Technologies (ATI) was a Sinker setup from Thursday’s Stocks to Watch column. ATI traded up and through the prior day’s high, the trigger for a Sinker setup. The setup triggered on a breakdown of support on a five minute chart. Depending on how tight your stop was on this fast moving stock, exit was either at a pullback after the sharp decline or end of day on a break up from the central pivot and crossing both the 8- and 20-simple moving averages.

Allegheny Technologies

Extra Innings for Friday, January 26, 2007:

BAX gapped up past our long entry today and we will be watching for potential follow through or Sinker opportunities tomorrow.

BAX

EAC scratched us out today, after a harrowing ride to a penny below our stop loss and back again to the entry. We’ll be watching for continued weakness tomorrow.

EAC

P.S. Join me and a dozen professional traders in the TraderInsight.com War Room. Click here for your free two-week membership.

Julie Peterson-Manz is cofounder of TraderInsight.com. Email her at Julie@peterson-manz-trading.net.

|