| Around the Horn: Nightly Review |

| By Julie Peterson-Manz |

Published

02/1/2007

|

Stocks

|

Unrated

|

|

|

|

Around the Horn: Nightly Review

On Thursday, we had five Stocks to Watch, four Around the Horn subscription trades, two Baltimore Chops and five Extra Innings on our radar. Of these, three hit for profits, one hit for a loss, two were scratches and ten were no-shows.

Getty Images (GYI) was a Backdoor Slider long setup from Thursdays Around the Horn subscription service. This was a textbook trade. Entry was soon after the open just below S1 at 49.56. GYI traded up to the R2 pivot and bounced back down. The stop at this point is breakeven, having already surpassed the 50% to target level. GYI eventually made it over this level and cruised higher to rest on support for the remainder of the day. Exit could have been anywhere along this range, but most likely at the failure to break to new highs and a drop below the 8- and 20-period simple moving averages.

Getty Images

If GYI was a textbook profit, Davita Inc. (DVA) was a textbook loss- that is, our stop was planned and we executed our stop without hesitation. DVA triggered our entry shortly after the open but couldn’t make it past resistance. Exit was at our planned stop loss close to mid-day.

Davita Inc

Equifax Inc. (EFX) was a Sinker pattern from Wednesday’s Stocks to Watch column. This was a prime example of this pattern, with EFX at new 52-week highs, we were looking for a retracement of Wednesday, but only after it triggered what would be a Fast Ball pattern (10 cents above Wednesday's high). EFX did just this, trading lower on the open and then quickly climbing past this trigger price. Entry was at this trigger level (1) as it fell through on the way back down. If not filled at this area, then a second entry opportunity presented itself on the drop from support at the morning lows (2). Exit was either at the cross of the 8- and 20-period simple moving averages (3) or below S1 (4), allowing for EFX to test the central pivot.

Equifax Inc

Sierra Health Services (SIE) was a long from Wednesday’s Stocks to Watch column. SIE hit our entry level off the open and traded just shy of 41.00 before pulling back. Exit was on the cross of the 8 simple moving average.

Sierra Health Services

Honorable Mention:

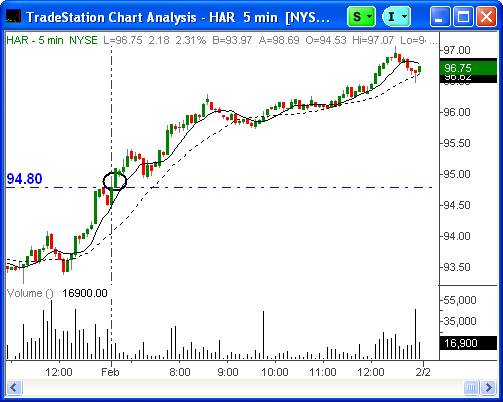

Harmon International (HAR) was a Backdoor Slider from Tuesday’s Stocks to Watch List that didn’t trigger. Wednesday’s action had it on our pocket list as a long and if you were with us in the War Room you saw it mentioned. Entry was 10 cents above Wednesday’s high and there was little reason to exit until end of day.

Harmon International

Extra Innings for Friday, February 2, 2007: (buckle up . . .)

Alright, so there are several Extra Innings from Wednesday’s list for Thursday that didn’t trigger and we will be watching many of these again Friday, including:

APA

PPP

TDW

FHN

BDX (we will be watching this one for a move in either direction)

Also, there are some moves from prior days that we’ll also be watching, including:

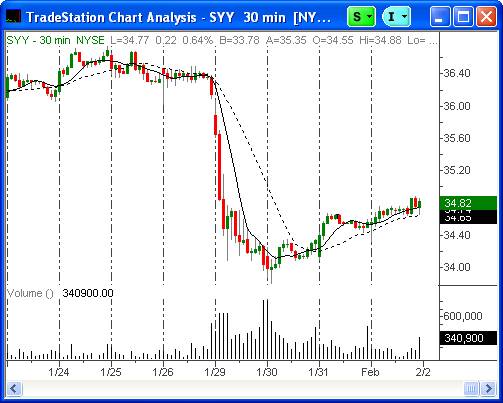

SYY (we will be watching this one for a move in either direction)

HAR (we will be watching this one for a move in either direction)

LYO

In addition, EFX, having fulfilled its Thursday’s Stocks to Watch Sinker pattern, has now formed a Double Header and we will be watching for continued weakness below the 20 day simple moving average of 40.34.

EFX

KBH (from Thursday’s Stocks to Watch column) may also follow through on Tuesday’s momentum on Friday.

KBH

P.S. Join me and a dozen professional traders in the TraderInsight.com War Room. Click here for your free two-week membership.

Julie Peterson-Manz is cofounder of TraderInsight.com. Email her at Julie@peterson-manz-trading.net.

|