| Around the Horn: Nightly Review |

| By Julie Peterson-Manz |

Published

02/6/2007

|

Stocks

|

Unrated

|

|

|

|

Around the Horn: Nightly Review

On Tuesday, we had four Stocks to Watch, two Around the Horn subscription trades and four Extra Innings on our radar. Of these, three hit for profits, one hit for a loss, two were scratches and four were no-shows.

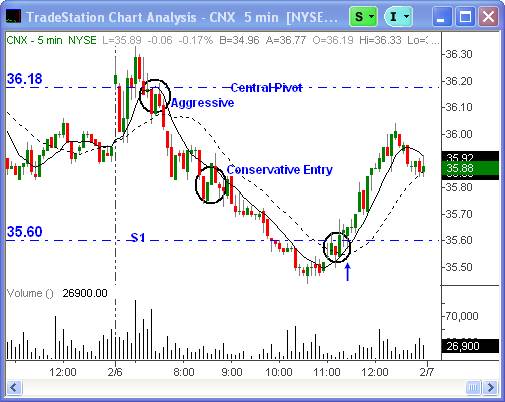

Consol Energy (CNX) was an Infield Fly short setup from Monday’s Stocks to Watch column. An aggressive entry on CNX was off the failure to hold the central pivot and drop below the 8 and 20 period simple moving averages. The more conservative entry was below Monday’s close and/or low. Either way, exit was after CNX couldn’t stay below S1 and crossed the 8 and 20 period simple moving averages.

Consol Energy

Barnes & Noble (BKS) was an Infield Fly short setup from Monday’s Around the Horn subscription service. BKS triggered our entry shortly after the open and showed great progress until it hit S1 pivot like a brick. BKS reversed from this level, flitting around the entry for the morning until heading back to its opening price. Exit was end of day, just shy of the stop loss.

Barnes & Noble

Harman International (HAR) was on Tuesday’s Nightly Wrap column as an Extra Inning. HAR was gapped up off the open and eventually filled that gap down to Monday’s highs. Entry was on a reversal after it filled the gap and a cross over R1. Exit was end of day.

Harman International

Honorable Mention:

TXU Corp (TXU) was a Fast Ball long setup from Monday’s Around the Horn subscription service. It gapped up today just beyond our entry level. While we will ordinarily take these if they gap within 10 cents of our entry level, this one slipped by us. An entry off the open was good until mid-day, trading just beyond the stated initial profit target of 56.38. Exit was at a fall below this level.

TXU

Extra Innings for Wednesday, February 7, 2007:

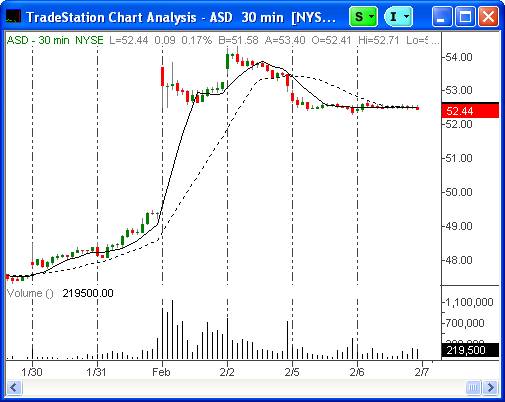

ASD may continue lower.

ASD

LYO may have found support and head back up to previous highs.

LYO

P.S. Join me and a dozen professional traders in the TraderInsight.com War Room. Click here for your free two-week membership.

Julie Peterson-Manz is cofounder of TraderInsight.com. Email her at Julie@peterson-manz-trading.net.

|