| Around the Horn: Nightly Review |

| By Julie Peterson-Manz |

Published

02/7/2007

|

Stocks

|

Unrated

|

|

|

|

Around the Horn: Nightly Review

On Wednesday, we had five Stocks to Watch, one Around the Horn subscription trade and two Extra Innings on our radar. Of these, four hit for profits, one hit for a loss, two were scratches and only one was a no-show.

Beckman Coulter Inc. (BEC) was a Double Header short setup from Tuesday night’s Stocks to Watch column. BEC hit the entry level shortly off the open and spent most of the day resting on the S1 pivot. Late in the day BEC followed the markets to the downside. Exit was end of day as BEC oscillated around S2.

Beckman Coulter Inc

Comerica (CMA) was a Fast Ball long setup from Tuesday night’s Stocks to Watch column. An aggressive entry of 10 cents above Tuesday’s close hit shortly off the open and traded up to the more conservative entry of 10 cents above Tuesday’s high. CMA continued higher, pushing through R1 but unable to hold this level. Exit was on the cross of the 8 period simple moving average on the break back below R1.

Comerica

General Growth Properties (GGP) was a Fast Ball long setup from Tuesday night’s Stocks to Watch column. This one also had Sinker (reversal short) possibilities and we scratched out of a short off the open. We were ready when the long follow-through presented itself, however, and an entry 10 cents above Tuesday’s high had this trade alive until end of day, trailing stops at support levels and giving it a little room to breathe. Profits could also have been taken on the larger pullbacks midday if the position had enough shares to make this reasonable.

General Growth Properties

TXU Corp (TXU) was a Line Drive long setup from Tuesday’s Around the Horn subscription service. TXU barely tagged us in at an entry of 56.59 only to fall sharply to the stop-loss at 56.22.

TXU Corp

Lyondell Chemical (LYO) was a long from Tuesday night’s Nightly Wrap column. LYO was gapped up into the area we were looking for profit targets. We waited for LYO to quickly fall from this open and find support just above S1 at the 30.58 level. An aggressive entry was just over the central pivot and a more conservative entry just above R1. Either way, LYO did climb back into Monday’s bar. Exit was off highs at a cross of the 8 period simple moving average.

Lyondell Chemical

Extra Innings for Thursday, February 8, 2007:

ETR has been hitting resistance for three days and may make another attempt tomorrow.

ETR

LYO may have found support and head back up or make a move to test lows.

LYO

BEC may follow-through to the downside, stretching back down to the 20 day simple moving average or to last weeks low of 63.26.

BEC

TXU stopped us out today, but may follow through on the long tomorrow.

TXU

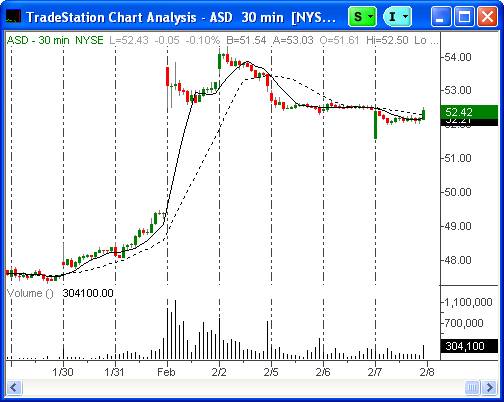

ASD still has quite a gap to fill and we’ll be watching for a move down.

ASD

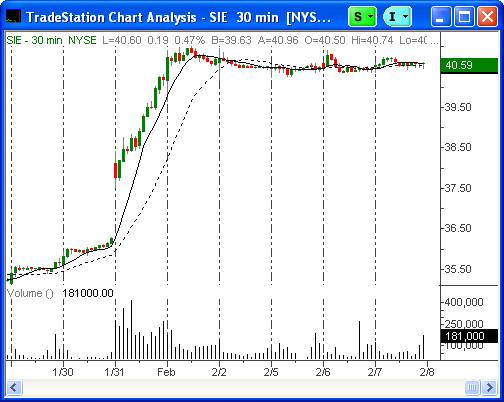

SIE has been trading in a narrow range since its Fast Ball move last week. We’ll be watching it again tomorrow.

SIE

P.S. Join me and a dozen professional traders in the TraderInsight.com War Room. Click here for your free two-week membership.

Julie Peterson-Manz is cofounder of TraderInsight.com. Email her at Julie@peterson-manz-trading.net.

|