| Around the Horn: Extra Innings for April 30 |

| By Julie Peterson-Manz |

Published

04/30/2007

|

Stocks

|

Unrated

|

|

|

|

Around the Horn: Extra Innings for April 30

On Friday, April 27, we had four Stocks to Watch and five Around the Horn subscription trades on our radar. Of these, three hit for profits, two hit for losses and four were no-shows.

Parker Hannifin (PH) was a Switch Hitter long setup for Friday’s Around the Horn subscription service. PH hit the entry off the open and traded almost directly to the initial profit target, consolidating at this level. Exit was at this level or partial shares peeled off at this level, with the remaining open until end of day, trailing the stop for these shares initially at the 50% to target, then the initial profit target.

Parker Hannifin

Accenture (ACN) was a Double Header short and Dow Jones (DJ) was a Switch Hitter long for Monday’s Around the Horn subscription service. Both barely tagged our entry price, only to stop us out at the planned stop loss.

Accenture

Dow Jones

Emerson Electric Co (EMR) was a Line Drive long from Thursday night’s Stocks to Watch column. EMR hit our entry and bobbled around this price much of the morning. Mid-morning EMR took off with a head of steam for the R1 pivot level. Exit was on a fall from this level. A second entry opportunity exited mid-day, with an exit at R1 again toward end of day.

Emerson Electric Co

Pilgrim’s Pride (PPC) was an Infield Fly short from Thursday night’s Stocks to Watch column. PPC hit the target off the open and kept falling for most of the morning. Exit was anytime after hitting support mid-day. If exit was not taken on the way to the.382 fib level pullback, then a test of that level resulted in another move to lows of the day. Exit was anytime after this up to end of day.

Pilgrim’s Pride

Extra Innings and Opportunities for Monday, April 30, 2007

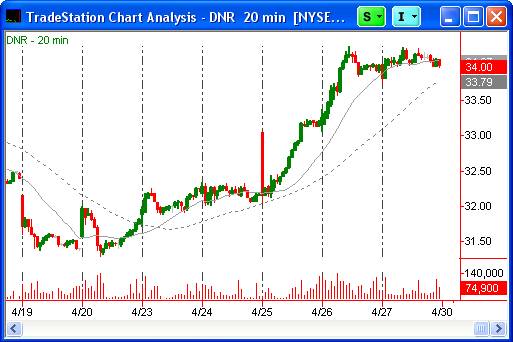

We’ll be looking for continued strength in Denbury Resources (DNR) & Accenture (ACN) and weakness in Thermo Fisher Scientific (TMO).

Accenture

Denbury Resources

Thermo Fisher Scientific

P.S. Join me and a dozen professional traders in the TraderInsight.com War Room. Click here for your free membership.

Julie Peterson-Manz is cofounder of TraderInsight.com. Email her at Julie@peterson-manz-trading.net.

|