| Core Inflation vs. Headline Inflation |

| By John Mauldin |

Published

05/19/2007

|

Currency , Futures , Options , Stocks

|

Unrated

|

|

|

|

Core Inflation vs. Headline Inflation

Summer driving season is almost upon us. I remember more than a few long road trips with young kids, who would eventually get bored and tired and lulled into sleep, and with a stop for gas would wake up and ask, "Are we there yet?" or "Where are we?" They would be impatient to get "there" (ok, so was Dad), and the journey was something to be endured rather than enjoyed for its own sake. Today, traveling with the older kids (6 of them 18-30, with just one still at 13) is a lot different, as we look forward to the time together, with great conversation and lots of laughs.

I bring that up as a way to introduce this week's letter. I have been suggesting since last fall that the potential for a recession/serious slowdown was quite high, brought on primarily by weakness in the housing market. Today we look at why I still hold that view, as the data shows a slow leak of the housing bubble and consumer spending starting to slow as inflation eats into buying power, even though some data shows that some parts of the economy are still strong. Unlike Bernanke, who this week said that the problems in the subprime markets will not spill over into the economy, I expect the subprime mortgage predicament to infect the whole housing market and create a drag on the whole economy. Depending on what you want to hear, you can decide that this week's inflation data was positive or a problem, that housing is rebounding or going further into recession, and that consumer spending is starting to rise or fall. Bulls see it one way and bears another.

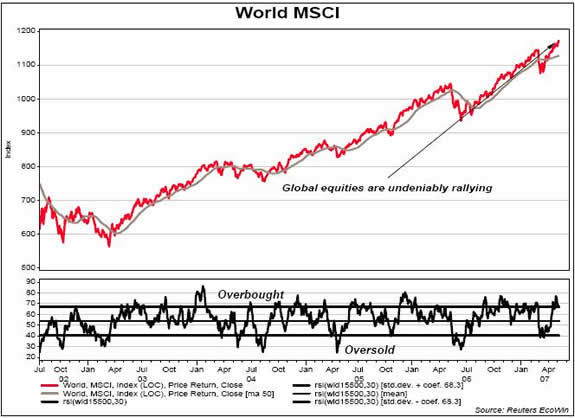

Clearly, from a stock market point of view, there is nothing to be worried about. What slowdown? Recession? I spit on your recession! Like a kid in the middle of a long road trip, it is hard to be patient. There has never been a recession without an accompanying serious bear market. It is tough to be sanguine about the near-term prospects for the stock market if you see a recession in the future. Stock market investors clearly must believe either that there will not be a recession or that for the first time the market will continue to rise. Waiting for that correction brings back memories of the impatient question "Are we there yet?"

And it is not just in the US. Look at the graph of the World MSCI since the middle of 2002 (courtesy of my friends at GaveKal). What a run. The US is actually in the bottom 20% in terms of stock market performance in the last 12 months.

And the performance is somewhat justified. GaveKal notes there are just two countries in recession at this time: Lebanon and Zimbabwe. There are over 100 countries that have recently enjoyed annualized growth of over 4%. For the first time since 1989 another country will contribute more to global growth than the US. Back then it was Japan. Now it is China. The four BRIC countries (Brazil, Russia, India and China) combined are now bigger than the US economy. So, if and when the US economy slows down more, it will not have as much of an effect as it did in past decades, and that is a good thing.

So, why am I such a Gloomy Gus? Isn't it time to get on the bandwagon? And make no mistake, I fully expect to become a bull in the middle of the next recession and stay that way for a long time. (It's not that I have missed out in my personal portfolio, as there are other ways, as I have written, to invest besides a long-only US stock portfolio. It is just a whole lot more fun to have a bullish slant to your writing.) With that in mind, let's look at some concerns I have about the US economy.

Core Inflation vs. Headline Inflation

Inflation (consumer price index) came in this week. If you looked at core (without food and energy) inflation, you had to be happy. It continues to drop closer to the so-called Fed comfort zone of between 1 and 2%. It was just 0.2% for the month of April, which is about 2.4% on an annualized basis, down from 2.5% the previous month. The trend this year has been a slow decrease in core inflation.

The Fed prefers to look at core inflation when it is making its decisions on whether to raise or lower rates. So, this would suggest that maybe the Fed can begin to signal a rate cut at its June or at the latest its August meeting.

But out here in the real world we actually do buy food and energy. And headline inflation (the total inflation rate) is starting to trend much higher. It was at 0.4% in April, which is an annual rate approaching 5%. But the recent trend is worse.

Over the last six months, the rate has been 4.7%. The three-month rolling trend is up to 5.7%. That is the wrong direction. "The 2.4% increase in the energy index was the second consecutive large increase and pushed the three-month rolling annualized growth rate [of energy inflation] to a massive 43.5%. This is the largest gain since September 2005, when Hurricanes Katrina and Rita caused havoc in the energy market." (Economy.com)

Few people I know slice and dice the details in the data better than good friend Greg Weldon (www.weldononline.com). Let's look at some of the tidbits he found buried in the CPI data.

Food at home prices (different than restaurants) are rising at a three-month rate of over 8.6%, up from only 0.8% in January. Alcoholic beverages (!) are up 7.1% on a three-month basis versus 2% in January (bad news for bud Art Cashin and the Friends of Fermentation at the NYSE). Ditto for meat, poultry, fish, and eggs at 10.1%! Overall, the three-month rate for CPI food has spiked to 6.4% since being at 2.1% in January.

For most of the country, food and energy are at the core of our expenses. When we spend more on food and energy, we have less to spend on other goods and services.

If core inflation drops below 2%, the theory is that it gives the Fed "cover" to lower rates and help stem the bloodletting in the housing market. But that assumes a rather benign overall environment. It would be hard for the Fed to maintain credibility if it cuts rate when the overall inflation rate is over 5%. Talk about spooking the bond market. It would bring up long-suppressed nightmare memories of the '70s and stagflation.

Let's look at what Bill Gross of PIMCO wrote this week in an otherwise quite bullish (for him) essay:

"A bigger threat to asset markets however, comes not from slower economic growth in the short-term, but inflationary pressures towards the end of our secular timeframe. Note first of all the increasing influence of non-core food and energy prices in G-7 nations over the past few years as illustrated in Chart 5 for the United States. Since 1967, average differences in headline vs. core inflation have essentially been zero, despite distinct periods of cyclical variation. Now, however, with globalization so dominant and Chinese/Asian appetites for oil, soybeans, and iron ore amongst other commodities so voracious, it's hard to envision an extended period of lower headline U.S. increases. This may bias more central banks to begin considering headline numbers in their policy decisions like Japan and the ECB do already."

Real vs. Nominal

And inflation can be a problem if it is rising as the economy is slowing, limiting the Fed's ability to cut rates. If inflation continues to rise this quarter, it does not bode well for real (inflation-adjusted) GDP. Let's look at why that is the case.

Nominal GDP (Gross Domestic Product) is the level at which the economy grows without taking into consideration inflation. Real GDP takes into account inflation. To get real GDP, you simply subtract inflation from nominal GDP.

Real GDP last quarter was initially estimated to be 1.3%. Economy.com, for a variety of reasons, now thinks that will be revised downward to 0.7%, the slowest rate since the fourth quarter of 2002.

The GDP price index rose at a 4.0% rate in the first quarter, the fastest increase since 1991. Nominal GDP growth - real GDP plus inflation - grew at a 5.3% rate. The first-quarter spike in the GDP deflator, the largest in 16 years, has to have the Fed concerned. You can talk about core inflation all you want, but the price index is what counts at the end of the day when measuring the growth of the economy.

And halfway through this quarter, the data cited above suggests inflation is still rising. If inflation stays at over 5% for the quarter, we could be close to a "recession"-type number if nominal GDP does not rebound, and there are reasons to think a rebound is not in the cards.

Unemployment certainly looks like the economy is doing better, with both continuing and initial job claims falling. There are various signs which suggest manufacturing may be picking up from the doldrums it has been in.

But there are signs of weakness. Dr. Lacy Hunt (Van Hoisington Management) tells us that railcar loadings are down 4.3% year over year (y/y) for 2007-to-date (thru first week of May) and the first week of May is down 4.9% y/y, and trucking tonnage has declined y/y in 4 of the past 5 quarters.

Housing is not helping, and is likely to put at least a 1% drag on the economy this quarter. And the data suggests we are not close to a bottom. Let's look at what Greg Weldon wrote about the data released this week by the National Association of Home Builders.

"First we shine the spotlight on the National Association of Home Builders Housing Market Indexes, revealing SOURING final demand as reflected by LOW Buyer Traffic and plummeting Single Family Sales readings in May:

Single-Family Sales Index ... 31 ... down from 33 in April, down from 36 in March, and down from 40 in February.

Traffic of Prospective Buyers ... 23 ... down from 27 in April, down from 28 in March, and down from 29 in February

"Last we looked, the weather in most of the country was HORRIBLE during February, as exemplified by the vicious St. Valentine's Day ice-storm that crushed the Northeastern US ... and quite nice in early May. So on a seasonal basis, we MUST 'read' the data as being ALL the MORE negative, as a proxy for measuring the final demand side of the equation.

"Moreover, the reading on Single-Family Sales (31) is SHARPLY lower than the year-ago May-2006 reading of 50, and FAR below the cycle high of 78 set in December of 2004. Similarly, the lowly 23 reading posted by the Traffic of Prospective Buyers Index is LESS than HALF of the cycle peak set in June-July of 2005, at a reading of 55. Oh, and the Single-Family Sales reading is the LOWEST in SIXTEEN YEARS, since the secular low set in January of 1991!!!"

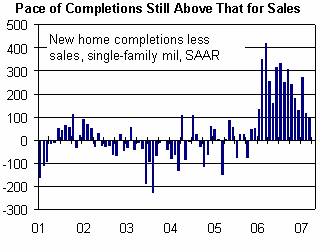

There are some who take heart as housing starts rose for the third straight month. How can things be all that bad if homebuilders are still putting up homes? The reality is somewhat different. Permits dropped this last month, and starts lag permits by about one month, which suggests that new home construction is going to get weaker. Builders are reducing the number of unsold homes in their inventories, down about 16% from their peak in March of 2006. But the downside is that sales are still lower than completions.

Even as homebuilders are slowing the pace of building, the number of unsold homes rises, as sales are slowing much faster than builders anticipated. And that is in spite of a favorable interest-rate environment and lower prices. Look at the chart below to see the rise in inventories (homes built in excess of homes sold) over the past few years. It is really rather sobering to view.

Supply and demand ultimately determines how many homes will be built, but it takes time for the two to equalize. Getting a handle on that process will help us understand how much of a spillover effect the housing market slowdown will have on the economy.

"A cursory examination is not encouraging. This is mostly because demand weakened much faster than builders anticipated through mid-2006. Although they have been feverishly slashing production over the past year, it takes about seven months from the time a permit on a house is granted to its completion. Thus, only the first wave of cuts in permits and starts has fed through to new home inventories, which have risen in the first few months of 2007 after edging down ever so slightly in the last quarter of 2006." (quote and graphs: Economy.com)

"After adjusting for units pre-sold before construction, which have averaged close to 350,000 per year since the late 1960's, single-family completions are still running about 100,000 units at an annual rate above the level of new home sales. Sales are tracking above single-family permits (also adjusted for homes built but not put up for sale), which means that completions will fall below sales before too much longer. That said, the difference between the two is not very large, consistent with the slow adjustment process in supply and demand that is now manifesting in the data.

"Downward pressure on prices should hold in place at least through early next year. Completed home inventories, which make up about one-third of the total and are the most potent for pricing since they are the most costly to maintain, have yet to roll over. Only when this category begins to decline with more vigor will months' supply of new homes begin to trend definitively lower."

For residential investment to stop contracting, shifting to a neutral and ultimately positive driver of GDP growth, the enormous overhang of inventories will need to be reduced, and measurably so. There are almost 4.5 million homes for sale, and about half of these are vacant. And as long as homebuilding is a direct drag on growth, the risk that spillover effects will prevent GDP growth from rebounding, even as the inventory cycle turns pro-growth, will remain significant.

Mortgage rates today are roughly 50 basis points (0.50%) lower than they were a year ago. Home prices are lower and thus the affordability index is rising. But given the tightening of credit standards, especially in the less-than-prime category, the data suggests that home buying is going to get weaker in the near future, which will continue to put downward pressure on the economy.

A Crack in the Consumer Armor?

Retail sales were decidedly punk in April. On Thursday Wal-Mart reported a 3.5% drop in sales in April at US stores open at least a year, the largest decline since the world's largest retailer began reporting same-store sales results in 1979.

And it was not just Wal-Mart. Target reports that sales at stores open at least a year fell 6.1%, hurt by a sales shortfall in the first two weeks of the month. Chain store sales fell 2.4% in April, the first decline since March 2003 and the largest on record back to 1970. Some of the decline was due to the shift in Easter sales, and the average growth over March and April was a positive 1.8%; but this was still the weakest growth since November 2004. Total retail sales fell 0.2% in April, despite strong growth at gasoline stations. Non-auto sales were unchanged, while sales at auto dealers fell.

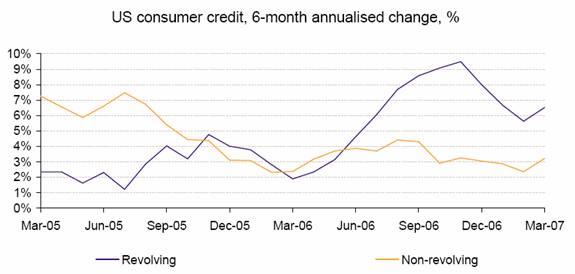

Look at the chart below reproduced from Lombard Street. Consumer credit, especially high-interest credit-card debt (revolving), is once again growing at a faster pace.

The consumer is getting squeezed on all sides, and the piggy bank that has been home equity loans fueled by ever-rising home values is getting closer to being tapped out. Consumer spending on nonessentials certainly seem to be under pressure.

So, let's sum it up. The housing market is still slowing. Consumer spending is slowing. Overall inflation seems to be rising, which will make it difficult for the Fed to cut rates in what seems to be an ever-closer recession.

Call me old-fashioned, but this is not the environment that has been positive for the stock market in the past. Maybe things are different, and I am just missing it.

And as for a recession, are we there yet? Maybe, or at least close enough that we should fasten our seatbelts in preparation for a landing. (As the flight attendant just told me - I am somewhere over the mountains in California) Let me tell you now the spin you will hear in a few months if we find that we are in or close to recession numbers (not that the under 1% we saw last quarter wasn't close):

"It's only a technical recession because of the high inflation numbers caused by energy and food. If you take those out the economy is just fine. And please buy my stock, fund, etc. because things are going to get better."

You gotta love it.

Ethanol Madness

As an aside, much of the inflationary rise in food costs is because of high grain prices, which are a result of ethanol subsidies. Given that prices have risen even higher recently, that means there is even more food inflation in the pipeline. This is just another unintended consequence of what happens when government starts meddling in the markets. We make a few farm-state senators happy and the rest of the world gets higher food prices. While most of my readers can afford to pay a little more for our chips and salsa, it is a very tight squeeze on the poor of the world.

We need to start phasing out these subsidies as soon as possible, recognize that sugar ethanol is cheaper, and just deal with it. Maybe that means in a political compromise we have to bail out some investors in ethanol plants, but the longer this goes on, the more pain it is going to cause to people who are not able to afford it. I am all for creating new ways to reduce our need for foreign oil, but let's not do it on the backs of the poor in developing countries.

And speaking of environmentalism, I close with this gem from good friend Dennis Gartman, who often hits it out of the park with his comments. This one goes 500 feet.

"CATECHISM CLASS: Raised as good Lutherans back in Ohio, we always understood how the selling of Indulgences helped bring the Catholic Church low in the 16th Century. Indulgences were the pieces of paper sold by the Pope that allowed 'sinners' to pay down their debts they had incurred through sinning. One could sin, buy an Indulgence from the Church, and go about one's life with a sense of having done something worthwhile for the building of more churches AND in curtailing one's time in purgatory or actually buying one's way into heaven. Indeed, we learned that one of the Popes of the age, Leo X, actually sold such large Indulgences, costing such large sums of money, that he was able to finance the rebuilding of St. Peter's Basilica. Having been to St. Peter's, in retrospect, perhaps this was not such a bad idea given the stunning beauty of the church.

"But the whole notion of Indulgences is being revisited these days by the new religion of global warming, for if we consider what Mr. Gore has recently done by buying carbon offsets from those who plant trees to offset his enormous carbon footprint, or knowing what Sen. Edwards has done by buying offsets to the electricity and energy needed to power his enormous home in Chapel Hill, N. Carolina, we are hard pressed to see where this practice differs from the 16th century selling of Indulgences.

"Parishioners in the 16th century bought their way out of Purgatory and/or Hell; 21st century tree-hugging energy users can buy their conscience clear by buying offsets. We look for arguments from our global warming friends out there." Yea and verily.

John Mauldin is president of Millennium Wave Advisors, LLC, a registered investment advisor. Contact John at John@FrontlineThoughts.com.

Disclaimer

John Mauldin is president of Millennium Wave Advisors, LLC, a registered investment advisor. All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors before making any investment decisions.

|

|