| Short-Term Range Trade for USD/CHF |

| By David Rodriguez |

Published

06/1/2007

|

Currency

|

Unrated

|

|

|

|

Short-Term Range Trade for USD/CHF

Trading any of the majors this past week was a risky venture since most of them were perched on significant technical levels and event risk was high. Now that the week is over, the fundamental barrier to trading the pairs is gone; yet the levels on the chart are still in place. USDCHF has a particularly compelling chart set up. Resistance is very significant in its confluence of a high level moving average, Fib of a big wave and a long-term falling trendline. Spot needs to bounce modestly to trigger an entry, but it is necessary to preserve risk/reward – especially since a wide stop is vital to protecting against false breakouts. Taking a long position on the range is risky. Support is not solid and has only been test once. What’s more, between the big falling trend line and the recent rising channel, the node of resistance seems more established – and therefore has the greater probability of winning out on the medium-term direction of the pair. So, if conditions do not seem promising, do not take the risk on a long trade.

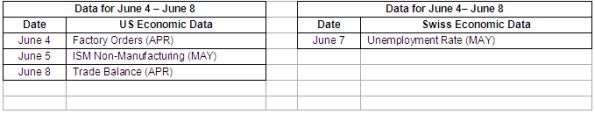

US – Fundamental risk on the US side will be quite meager this week, and the Trade Balance is the only event that is likely to make waves. The figure is anticipated to show a mild narrowing in the deficit, but there is a chance the balance will actually be released better-than-expected as a weak US dollar supports export growth. Factory orders may feel similar affects, with the index forecasted to gain once again in April, albeit at a far slower pace. Meanwhile, ISM Non-Manufacturing may edge back to 55.5 from 56.0, but with the services sector gauge still well above 50, the indicator will likely continue to reflect expansion in the sector.

Switzerland – Event risk out of Switzerland will be inordinately thin as well this week with only the Unemployment Rate scheduled to be released. Nevertheless, the reading could bring about a bit of volatility as the labor market is anticipated to tighten even further. Continued improvements in employment conditions have been a major contributor to consumption and domestic demand growth, keeping the economy on track to maintain the Swiss National Bank’s expansion expectations of 2.0 percent this year. Furthermore, an encouraging Unemployment Rate will ramp up expectations for a hike by the SNB on June 14th.

John Kicklighter is a Currency Strategist at FXCM.

|