| Chinese Trade Surplus Soars 73 Percent |

| By John Kicklighter |

Published

06/11/2007

|

Currency

|

Unrated

|

|

|

|

Chinese Trade Surplus Soars 73 Percent

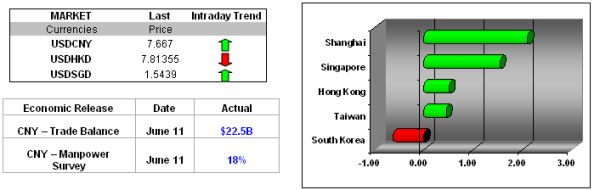

China’s trade surplus, as many had feared, ballooned by the tune of 73 percent on the annualized comparison in the month of May. For the record, the gap widened to $22.5 billion according to the country’s customs bureau, rising well above estimates of $19.5 billion by the consensus. Exports surged higher by 28.7 percent , supporting the overall surplus and helping to drive the economic growth of 11.1 percent seen in the first quarter. Comparatively, imports rose by a more meager 19.1 percent. Now with a sum much greater than the $16.9 billion seen in the month of April, the Chinese economy will more than likely return to market focus, especially with the upcoming Congressional report of foreign exchange and forthcoming legislation on potential currency market intervention. Additionally, it may continue to feed protectionism, running through both countries. Last week, US Treasury Secretary Henry Paulson noted that protectionism and protectionist accusations may arise in the near term, worsening trade relations between the two countries. The impending situation does not look as bright as some would have hoped, and will likely place China into a corner that will be difficult to play out of.

Europe Union Likely To Press China for More Flexibility

In similar fashion to the US advocacy of open and freed markets, Euro zone policy makers are also clamoring for access to the world’s fastest growing economy. Trade Commissioner Peter Mandelson has made accusations towards none other than Chinese officials, claiming that the Commerce Ministry has played a deaf ear to Europe’s calls for reforms. In particular, European officials continue to call for access to service markets and pledges by the Chinese to curb intellectual property piracy. The row also entails current restrictions by Chinese companies in importing goods such as steel from abroad. Incidentally, the lift on the ban would increase imports of raw materials, helping to dampen the attention on the current trade surplus with the world. As a result, Mandelson is scheduled to meet with Chinese Commerce Minister Bo Xilai in Brussels tomorrow, in attempts to calm stormy waters. “Although EU-China trade is growing fast and suggests great potential….problems and serious outstanding market access issues six years after China’s WTO accession make the management of the relationship a huge joint challenge.”

Yuan Falls on Consumer Price Expectations

The Chinese yuan declined on the day following less than expected bond auction and a weaker fixing by the headline government. With inflationary pressures likely to rise, as per tonight’s reports suggest, investors continue to hold out for more rate hikes in the near term thus keeping yields higher. Subsequently, the headline government fixing also suppressed the Chinese yuan against the US dollar. For the third day, China’s central bank set the daily fixing lower in conjunction with rising dollar demand as of late. The combination helped to keep the Chinese yuan on the up and up, priced in at 7.6670 in the New York morning.

Asia Regional Stock Markets Buck Trend, Move Higher

On the heels of the Shanghai advance, regional stock markets moved higher. Notably, Singapore stocks advanced the most in four weeks, boosted by positive news that lifted key shares in Keppel Corp. and Cosco Corp. As a result, the Straits Times Index gained 53.87 points to close at 3,545.46, up 1.5 percent on the day. Supportive of the rally, Cosco Singapore shares surged higher by 40 cents to S$3.38, a record 13 percent, as the company won bids on contracts valued at $525 million. The contracts entail the construction of bulk carriers for companies in Turkey, Greece, India and Portugal. Comparatively, the Hang Seng Index rose for the first time in four sessions following news that two major insurance companies will pay a combined 10.9 billion yuan for a major investment in China Minsheng Banking Corp. The announcement boosted both China Life and Ping An shares in the overnight. As a result, the benchmark index added 106.34 points to close at 20,615.49.

Richard Lee is a Currency Strategist at FXCM.

|