|

Be Careful What You Wish For

Be careful for what you wish, because you may get it, and sometimes as H. L. Mencken wrote, you get it good and hard. The collective brain deficit trust, otherwise known as the US Congress, wish for the Chinese to revalue their currency upwards. Today we look at why they may indeed get their wish and why it is not going to produce their desired results. We look at a possible connection between China and the recent and odd volatility in interest rates, connect the dots on inflation and the US economy. How do you explain higher interest rates on government bonds and a slowing economy, but a relentless march to Dow 14,000? It is a lot to cover, so let's jump right in.

Last year, Senators Charles Schumer (D-NY) and Lindsey Graham (R- SC) introduced a bill which would put a 27.5% tariff on Chinese imports. There was not much chance of the bill passing, and given that such a tariff was illegal under World Trade Organization rules, it was clear the Senators were pandering to their various local constituencies. Not that they are not serious about punishing China for have the audacity to sell us cheap goods, while taking our dollars and investing them into US government debt, but their bill was mostly for show.

Be Careful What You Wish For

I wrote at the time that the Chinese would only revalue their currency when they were ready and not one day before. Bluffs and threats from the US Congress do nothing, as the Chinese will do what they want when they want.

This week, however, a more serious bill was introduced, which would require the US Treasury to coordinate with the Federal Reserve and intervene in currency markets when the exchange rates of other countries have become distorted. The bill would send exchange rates disputes to the World Trade Organization by treating them as unfair export subsidies and includes a range of sanctions. This bill has more substance as it actually might work within the rules. And unfortunately, it seems to have widespread bi-partisan support, although it is doubtful that President Bush would sign such a measure. And in two years, the question may be moot, as we shall see. China may decide for reasons of their own that it is time to allow the Yuan to rise at a faster pace. And the unintended consequences of that rise may give us at least as many problems as a clearly under-valued currency.

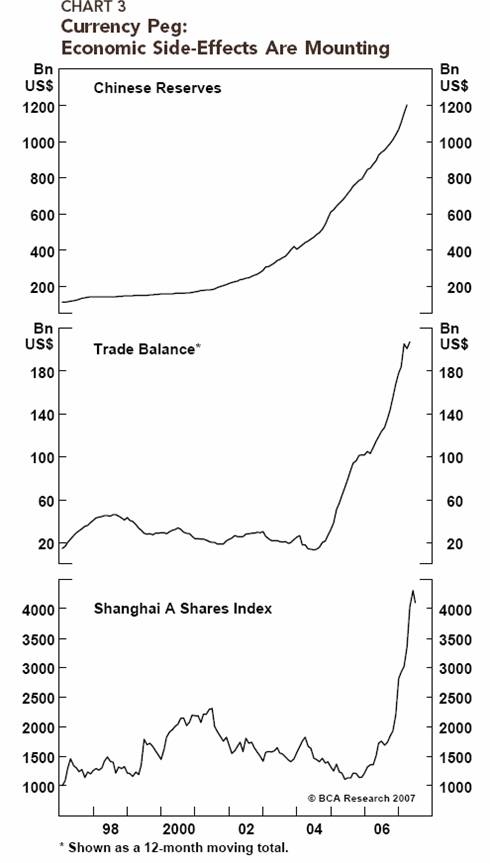

Let's set some background. Let's review some interesting data from this month's Far Eastern Economic Review written by Michael Pettis. (www.feer.com) China saw an astounding rise in their reserves in the first quarter of $136 billion to a total of $1.2 trillion. For sake of comparison, China's reserve increase in all of 2003 was "only" $117 billion. They grew $247 billion in 2006. Reserve growth is clearly out of control, and with it the growth of the money supply. And as we know, if the money supply grows to fast, it can bring an unwelcome round of inflation. And inflation can bring about an instability which the Chinese government definitely does not want.

Where does such growth come from? Part of it a rising trade surplus of $46 billion, which almost exactly doubled from last year during the same quarter. Foreigners invested another $16 billion. Growth in the portfolio and currency appreciation (mainly in the euro) adds another $15 billion. That still leaves $60 billion. Chinese authorities commented that some of this comes from the unwinding of swaps between the central bank and Chinese commercial lenders, some of it from foreign IPOs with the money coming back into China. But that number is just staggeringly large by any standards.

Last year the total Chinese trade surplus was $178 billion, and Chinese economists expect that to rise by 43% to over $250 billion. That is an astounding number.

But there may be more to that story. Simon Hunt writes that some of the trade "surplus" may actually be a way to get around currency controls, as it is difficult to get money into the country as China is desperately trying to keep a lid on investment and speculation.

Let's say you are a businessman in Country A with manufacturing and assembly plants in China. If your Chinese subsidiary underpays for the materials imported into China needed to make your products and then overcharges for what is exported, you now have "excess" profits and therefore currency in China. You can take that money and invest it in the Chinese stock market, which is up almost 400% in the past two years, and 200% in the last year.

That fact has not gotten lost on the locals, who are withdrawing money from their banks accounts and opening brokerage accounts at prodigious rates. Bank deposits are actually down. P/E ratios are now well over 40. The Chinese market is clearly a bubble, but that doesn't mean the party won't last for some time.

The Chinese economy is on target to grow at 11% real. This clearly has the leaders of the country worried. Premier Wen Jiaboa said at a National People's Congress in March of this year that the economy is "unstable, unbalanced, uncoordinated and unsustainable." Can you imagine what would happen if President Bush or any leader of a western country said such a thing?

How did China get to such a place? Let's review. The Chinese pegged their currency to the dollar in the mid-90's, and after the Asian crisis in 1997-98 the concern among many economists was that the Yuan was heavily overvalued. That has obviously changed.

Is It Time for the Yuan to Rise?

Even though China has allowed the currency to rise against the dollar in the past few years, in trade weighted terms, the Yuan has actually fallen by about 10% since 2001 on the back of the fall in the dollar. China has become even more competitive. And that competitiveness is fueling its growth. Let's look at a chart and some quotes from one of my favorite sources, Bank Credit Analyst.

This undervaluation "has fueled China's economic boom: China's exports have shot up massively, its current account has exploded upwards and its official reserve accumulation has sky-rocketed. Chinese manufacturers, aided by a super-competitive currency, have rapidly gained market share around the world. Chinese exports as a share of global trade was less than 3% in 1997. Today' it is close to 9%." (Bank Credit Analyst)

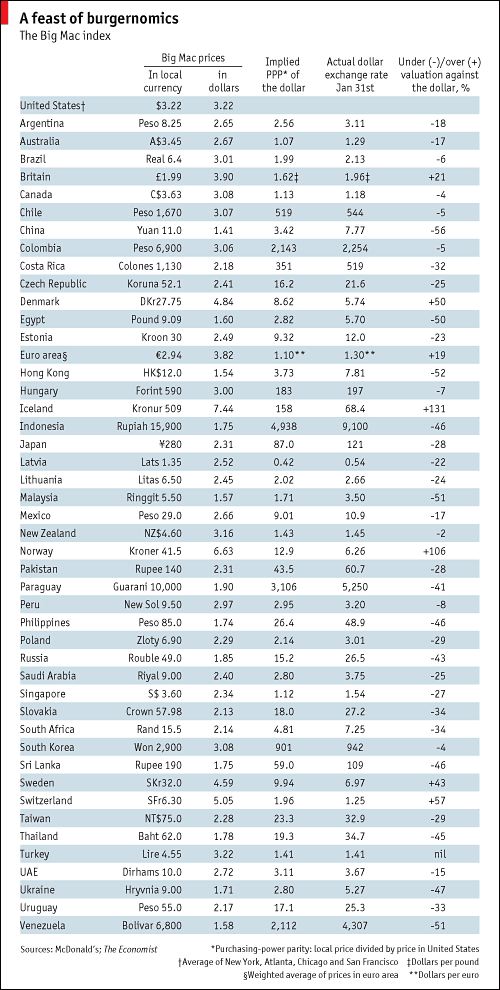

And BCA estimates that the Yuan is about 20% undervalued, based up purchasing power parity on consumer prices. But the less scientific and always interesting Big Mac Index suggests the number would be more than half overvalued by 56%.

A Tough Choice for China

There is a rule in economics. Central banks can control the value of their currency or the level of interest rates, but not both. You have to make a choice. China has chosen to control their currency against the dollar, but that means that interest rates are way too low. Real interest rates on bank loans are only 4% with real GDP at 11%. These low real rates are part of the cause of speculation and capital spending. If they allowed or forced rates to rise in order to help moderate growth and speculation, it would create even more demand for Yuan. As BCA notes, "The Chinese central bank is trying to achieve the impossible by suppressing both the Yuan and interest rates. The potential consequences of this policy are a rapid build-up in economic and financial distortions, a misallocation of resources and even a return of regulation on capital account movements."

Let's be clear. The politicians in Congress are right. China does have a huge advantage because of it lower currency policy. But the problem is a two way problem, and not just the fault of China. The US is the enabler in our co-dependent relationship. We continue to borrow and spend and consume. We do not save enough on our own to finance our own spending. We run a fiscal deficit which must be financed from abroad. Congress seems to think a weak currency is good policy for the US, but bad when the Chinese want to do it.

The solution is simply that we should be patient because the Chinese are going to have to deal with the problems that the policy is creating for themselves. Chen Zhao at BCA convincingly writes that the Chinese should float their currency now, and his arguments, or something like them, are certainly being discussed among Chinese authorities. If the Chinese do not get their runaway economy and misallocation of assets under control, they run the risk of a series of massive bubbles. Chen argues that:

"All of these economic problems suggest it is high time for the Chinese government to take bold steps to float the Chinese Yuan. Needless to say, there are legitimate concerns over the potentially negative impact a revaluation will have on Chinese manufacturers, but there are many major positives that will come with a freely floating Yuan.

"First, the authorities should not underestimate the ability of Chinese manufacturers to absorb the impact of a stronger currency. During the Asian crisis, the Chinese Yuan was revalued by over 30% overnight because of the wholesale collapse in other Asian currencies. Chinese exporters not only survived the shock but also thrived.

"Today, we have a much stronger world economy than in 1998, and therefore a better environment to help Chinese manufacturers overcome the short term difficulties. It is also wrong to believe that a stronger Chinese currency always works against Chinese manufacturers. In fact, a revalued Chinese currency would lower import costs of raw materials, helping manufacturers preserve profit margins.

"Second, by floating the currency the foreign exchange market could help the Chinese central bank tighten liquidity expansion - a necessary move to contain asset bubbles and reduce the speed of economic expansion. By moving to a floating exchange-rate regime, the Chinese central bank will regain its ability to adjust interest rates to appropriate levels. This will not only help pave the way to liberalizing the financial system, but it will also stem any further misallocation of resources.

"Third, the Chinese have saved too much and consumed too little, creating a burgeoning current account. A strong currency will help the Chinese reduce excess savings by promoting consumption while discouraging net exports. This would be a healthy shift in China's growth orientation, which would also reduce trade tensions with the U.S.

"Finally, the Chinese government has a fear over floating the Chinese currency: The authorities have long been frightened by the prospect of an exodus of hard currencies, leading to a depletion of reserves and a currency crisis. However, the Chinese government should realize that circumstances have changed dramatically from the 1980s and 1990s.

"The headache today is that China has too much reserves and the government is trying to find ways to encourage capital outflows. In the meantime, China has been a huge net creditor, and its foreign debt is minimal. There is no risk of a currency crisis in China by making the Yuan a freely traded currency."

While I do not think we will wake up and find the gradualist Chinese simply announce a fully floating currency, I do think they will allow the Yuan to rise at an ever faster rate. It is entirely possible that the 20% overvaluation that BCA suggests could melt away in 3-4 years. But before we start cheering that result let's look at some of the consequences. There is, as they say, the potential for collateral damage (pun intended).

If they are not pegging the dollar that would allow the Chinese to shift their reserves assets into currencies that they KNOW are going to outperform the dollar because of their own actions. It is clear that part of the conundrum of lower long term interest rates is in part answered by massive foreign central bank investment into dollars. If that starts to go away, you will also see the conundrum of lower rates go away as well.

And that policy may in fact be happening as I write. Greg Weldon, on of my favorite purveyors of all things financial, offers us some interesting insight into the Treasury International Capital (TIC) data released Friday morning. He looked into some of the details that have to raise some eyebrows this weekend. It explains why stocks and US equities are soaring and US Treasury bonds are under such severe pressure. Let's look at the TIC data from Greg (www.weldononline.com)

"*Total Net Foreign Purchases of Agencies ... $36.12 billion, more than double March's $15.14 billion, and FAR MORE than $2.43 bln in Feb.

"*Total Net Foreign Purchases of Equities ... $27.42 billion, more than three times the March total of $8.77 billion, and more than twice February's $12.39 billion.

"*Total Net Foreign Purchases of Corporate Bonds ... $33.53 billion, and while less than in March of February, the three-month cumulative total is a mind-blowing $124.24 billion.

"Between Agencies, Corporate Bonds, and Equities, foreigners made net cumulative purchases of $97.07 billion during the month of April. With that figure in mind, nearly $100 billion, we note:

"Total Net Foreign Purchases of US Treasuries ... $ 0.376 billion Yes, less than $400 million, or, less than HALF A BILLION. Out of $97.4 billion in "Net Domestic Securities Purchased", US Treasury paper constituted ONLY four-tenths of one percent of the total.

"There is NO fear. There is only excess USD liquidity that is flowing into everything EXCEPT the "low risk, flight-to-safety' sector ... the US Treasury market. Moreover, "Official Foreign Institutions" (ie: global central banks) were net BUYERS ... meaning ... private foreign institutions and investors were actually DUMPING US BONDS, and reallocating more heavily into equity purchases."

There is no reason to think this has stopped. It is driving the markets, raising both stocks and interest rates. And then Greg brings us to the point that is germane to our discussion on China. I haven't seen anyone else note this, which is one of the reasons Greg is a must read for me. He finds these details.

"MORE problematic ... and something NO ONE seems to be talking about, China REDUCED their holdings of US Treasuries. Again ... the Chinese Central Bank DUMPED US Bonds in April. Note:

"Chinese Holdings of US Treasury Bonds ... $414.0 billion, DOWN (-) $5.9 billion in the month, falling from $419.8 billion.

"Again, we magnify the point ... China sold 1.5% of their UST holdings. Bottom Line: the management of Chinese USD reserves (not to mention Korea, an active 're-allocator"), are helping reflate asset markets, and helping push US bond yields higher."

Hmm. The Chinese sell $6 billion in Treasuries and spend $3 billion to buy 10% of Blackstone. Kind of makes you wonder where the value is? Would I rather have a dollar in Blackstone (at Pre-IPO prices) or a dollar in US treasuries? Beijing is making a statement. Some sane heads in Congress should pay attention.

I do not think China will make a massive "all-at-once" shift away from US treasuries. But they could certainly continue to re-deploy assets away from US treasuries. And they will likely be accompanied by other smaller central banks with large reserves as well. We could see some serious pressure on US government bond interest rates.

And it is interesting to note that the growth in Chinese exports was in large part delivered because of European markets. Europe is the new customer for China, and it makes sense then that they increase their euro holdings. But that is not dollar or interest rate bullish

Inflation is in the Eye of the Beholder

A quick note on the inflation data that was released today. How you looked at it depends on what you wanted to see. Core inflation was rounded down from 0.149% to 0.1% in the headlines. The market saw that lower than expected number and soared. Part of the reason for the lower number is Owners' Equivalent Rent, which is over 30% of the core inflation number. With all the homes for sale that are not selling, it is clear that owners are starting to rent them in order to get some cash flow, and that is putting pressure on rent prices. Thus core inflation was up only 2.2% over the last 12 months, and is clearly moderating as the economy is slowing.

However, if you looked at total inflation, the number was higher, at 2.7% year over year. Food and Beverage was up 3.9% and energy was up 4.7%. During the first five months of 2007, CPI rose at 5.5% on a seasonally adjusted annual rate (SAAR).

This compares with an increase of 2.5% for all of 2006. The acceleration thus far this year was due to larger increases in the energy and food components. The index for energy advanced at a 36.0% SAAR in the first five months of 2007 compared with 2.9% in 2006. Petroleum-based energy costs increased at a 63.9% annual rate and charges for energy services rose at a 6.8% annual rate. The food index has increased at a 6.2% SAAR thus far this year, following a 2.1% rise for all of 2006. Excluding food and energy, the CPI-U advanced at a 2.1% SAAR in the first five months, following a 2.6% rise for all of 2006.

The real question is can you credibly ignore rising food and energy inflation if you are a voting member of the Federal Reserve committee. I think not. And if China allows their currency to rise, that means we will be paying more for their goods, which is inflationary. It will also allow the countries that compete with them for the US market to allow their currencies to rise, which will mean inflation across the board for a lot of goods.

The prospect of rising interest rates and stubborn inflation, and a Fed that cannot credibly cut rates for a lot longer than the market thinks is very real. Senators, be careful for what you wish. We just may get it good and hard.

John Mauldin is president of Millennium Wave Advisors, LLC, a registered investment advisor. Contact John at John@FrontlineThoughts.com.

Disclaimer

John Mauldin is president of Millennium Wave Advisors, LLC, a registered investment advisor. All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors before making any investment decisions.

|