| Around the Horn: Extra Innings for July 20 |

| By Julie Peterson-Manz |

Published

07/20/2007

|

Stocks

|

Unrated

|

|

|

|

Around the Horn: Extra Innings for July 20

Thursday, we had four Stocks to Watch, two extra innings and three Around the Horn subscription service trades on our radar. Of these, three hit for profits, four were no-shows and two were scratch trades.

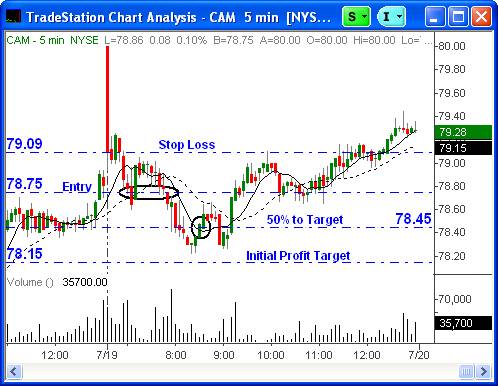

Cameron International Corp (CAM) was a Sinker short setup for Thursday’s Around the Horn subscription service. CAM opened high but soon sank down into our entry level. After the first entry opportunity, our stop loss level kept us in and there was a second opportunity later in the morning. CAM traded down within 10 cents of our profit target, so we reset our profit stop to 50% to target, which was the exit.

Cameron International Corp

Oceaneering International (OII) was a Switch Hitter long setup for Thursday’s Around the Horn subscription service. OII gapped open to our price, but had another entry opportunity later in the morning. After an aimless morning, OII hit our initial profit target at R2 level mid-day. Exit, with all or partial shares, was at this level, with exit if remaining shares end of day.

Oceaneering International

Supervalu Inc (SVU) was a Sinker short setup for Thursday’s Around the Horn subscription service. SVU did not trigger our classic entry for the Sinker by testing Wednesday’s highs, so I was on alert for an intraday setup. Shortly after the open this entry presented itself in the form of a Breaking Ball consolidation pattern. An entry at this level was good until mid-afternoon. Exit was on a reversal of two closes on the cross of the 8 period simple moving average.

Supervalu Inc

Extra Innings and Opportunities for Friday, July 20, 2007:

Union Pacific

P.S. If you enjoy my column and would like to join our Intraday Trading Plan, it's only $1 for a 30-day trial. Click here to start receiving our best trading setups for every trading day.

Julie Peterson-Manz is cofounder of TraderInsight.com. Email her at julie@traderinsight.com.

|