| The Panic of 2007 |

| By John Mauldin |

Published

08/18/2007

|

Stocks , Options , Futures , Currency

|

Unrated

|

|

|

|

The Panic of 2007

End of the World or Muddle Through? This week I try to explain in simple terms the very complicated story of how we went from some bad mortgage loan practices in the US to the point of world credit markets freezing up. There is a connection between the retirement plans of Mr. and Mrs. Watanabe in Japan and the subprime problems of Mr. and Mrs. Smith in California. We find the relationship between European banks and problematic hedge funds. And finally, we try and see how we get out of this mess. Oddly, I think it is hedge funds (and maybe Warren Buffett) to the rescue, but not in the way you would think. It is a lot to cover, so let's jump right in. (And there are a lot of charts, so while this will print out long, it is only a little longer than the usual in word length.)

To say the credit markets are frozen is an understatement. Talking to any number of people who have been in the markets for decades, this is the worst in their memory. Ironically, it is the 100-year anniversary of the Panic of 1907, when one banker (J. P. Morgan) stepped in and provided liquidity to the markets. The central banks of the world are providing liquidity; but as we will see, it is not mere liquidity that is needed.

You cannot explain the problems with just one or two items. A perfect storm of this sort takes a number of factors all coming together to work its mischief. Bad mortgage underwriting practices, bad rating agency practices, a destruction of confidence, excessive leverage and then the withdrawal of that leverage, the need for yield, greed, and complacency which then in a Minsky moment (explained below) becomes paralyzing fear - all play their part.

An Alphabet Soup of Credit

But let's start at the beginning. In the early '90s, investment banks created a new type of security called an Asset Backed Security (ABS). And it was a very good thing. Essentially, investment banks would take a thousand mortgages or car loans or commercial mortgages or bank loans and put them into a security. You could have a Residential Mortgage Backed Security (RMBS) or Commercial Mortgage Backed Security (CMBS) or a Collateralized Loan Obligation (CLO) and then a Collateralized Debt Obligation (CDO).

I am going to grossly oversimplify the following description, but the principle is correct. Let's take a look at how a Commercial Mortgage Backed Security is created. If you are a bank or institution, when you make a loan on a mall or office building, you incur a certain amount of risk. If you hold 100 such loans, you can almost be certain that some of those loans are going to be bad. Further, you are limited in the amount of loans you can make by the capital you have in your company. But what if you could package up those loans and sell them? You get your cash back, and then you can keep the servicing fees and make more loans. But who would want to take the risk of your loans?

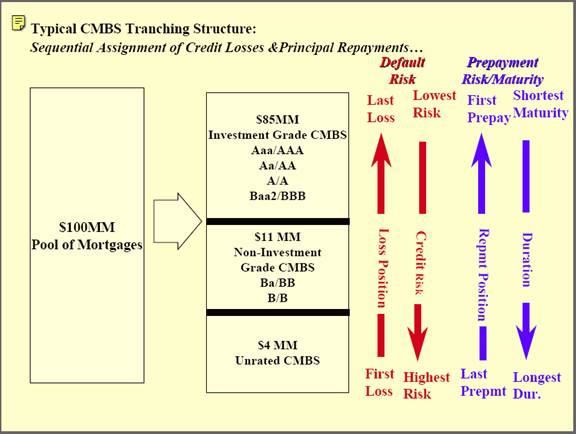

Through a form of financial alchemy, you can take your loans and increase the quality of them to potential investors. Let's say you have $100 million in commercial mortgage loans. You take this pool and divide it up into 5-7 (or maybe more!) groups called tranches. The first group gets the first (as an example) 60% of the principal which gets repaid. That means that 80% of the loans would have to default and lose 50% (80% of the loans times 50% loss is 40% total portfolio losses) of their value before your money would be at risk. If the bank originating the loan is not completely asleep at the wheel, your risk of an actual loss is quite small.

So, an investment bank goes to a rating agency (Moody's, Standard and Poor's, or Fitch) and pays them a fee to rate that tranche in terms of risk. Since the level of risk is small, that first tranche gets an AAA rating. Then the agency goes to the next group. Maybe it is 10% of the pool. It would get all the principal repayments after the first group. In this case, 60% of the loans would have to default and lose 50% of their value before your group lost money. The ratings agency might give this group an AA rating.

This process goes on until you get to the lowest-rated tranches. There is typically an "equity" tranche which is about 2-4%. That tranche is the last group to get its money repaid. In our example, if 8% of the loans went bad and lost 50% (8% times 50% is 4%) of their value, the equity tranche would lose all their money.

Let's assume the average interest rate on the loans was 10%. Because of the lower risk, the investment bank putting the CMBS together might decide to pay the AAA-rated tranche only 7%. Each successive tranche would get a higher rate, as they were taking more risk. The equity tranche is priced to pay in the mid-teens (or more) if all the loans are paid off.

Now, insurance companies, pension funds, and other institutions can buy this security that pays an interest rate higher than they could get from a similar government bond. This difference is called the spread. And in the beginning, spreads were high, as not everyone was comfortable with these new-fangled investments.

To see what I am talking about, you can look at the chart below, taken from the open education source at MIT. You can see the whole chapter here.

Let's also notice something. In order to get someone to buy the lower tranches you have to pay them more. So, the more of the loans you can get the ratings agency to classify as AAA, the more interest you can pay to the buyers of the lower tranches to entice them to buy. This is going to become an important point. (I should note that it also means you can charge higher fees for putting the deal together and selling it to your clients.)

Now, this financial engineering is a very good thing. It is one of the reasons for the worldwide economic boom, as it allows capital to invest in all sorts of loans that would normally be considered too risky. And for the vast majority of all these various alphabet securities, the ratings are going to be just about right. AAA CMBS or CLO paper is where it should be. Even AAA-rated prime mortgage paper, which is now selling for a discount, will (in my opinion) turn out to be just fine.

Investment banks put together all types of asset-backed paper. Car loans, mortgages, business loans, credit card debt, etc. are all fair game. And you can mix and match risk if you like. The combinations are endless. So it can be quite a complex task to analyze what you are buying. And to a very great extent, that analysis was delegated to the rating agencies. For all practical purposes, institutional buyers would look at the general classification of the security and then at the rating. It was on the screen, so they hit the bid. If you can't trust your friendly neighborhood rating agency, then who can you trust? And most of these securities had ratings from at least two if not three agencies.

But (and you know there is a but) there is a problem with subprime-rated paper. In the beginning, subprime loans were made the old-fashioned way. You had to have 80% loan to value and show you had a job and could actually pay back the money. And these loans were packaged up into a subprime Residential Mortgage Backed Security. Eventually, 80% of those loans would get an AAA rating. Now, this means that 40% of those subprime loans would have to go bad and the value of those homes drop 50% before the holders of that tranche of debt lost money. Even with today's loose lending practices, that is unlikely. I think any rating agency is going to be able to justify that initial AAA rating.

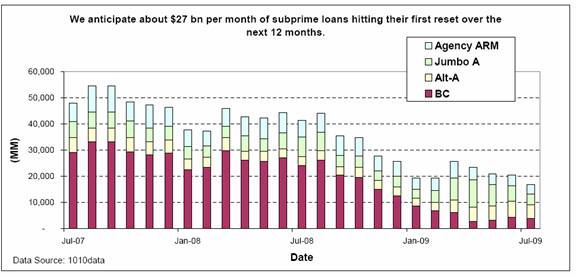

But then in 2004 loan practices began to change and had got completely out of hand by 2006. In 2005-6, about 80% of subprime mortgages were adjustable-rate mortgages, or ARMs, also called "exploding ARMs." These loans are so-named because they carry low teaser rates that often reset dramatically higher, increasing the borrower's monthly mortgage payments by 25% or more. Let's look back at what I wrote in March in this space.

"Let's say I want to buy a $200,000 home. I can qualify for an option Adjustable Rate Mortgage (ARM) with a starter rate of 2%. I can pay interest only for the first year, and then the rate goes to 5%. So, I have an interest payment of $4,000 a year, or $333 a month. But starting the second month, the interest is actually at 5%, so the real interest amount is almost $10,000, and the amount on my mortgage grows by roughly $6,000 the first year. I now owe $206,000 on the home. If I put down just 5% as a down payment, I now owe more than I paid for the house, if you take out 6% realtor fees when I sell! But as the interest rate resets in the second or third year, it can go up to 8%. I am now paying $16,500 in interest, and my monthly payment for just the interest is $1,375.

"According to reports from loan counseling agencies across the nation, the main reason homeowners give for falling behind on their mortgage payments is not a change in personal circumstances (such as a job loss), but instead, they are not able to make the increased payments on their ARMs.

"The loan application and review process for 'no-doc' loans was so lax that such loans are referred to as 'liar loans.' In a recent report by Mortgage Asset Research Institute, of the 100 loans surveyed for which borrowers merely stated their incomes on loan documents, IRS documents obtained indicated that 60% (!) of these borrowers overstated their incomes by more than half.

"The newer mortgage products, such as 'piggyback,' 'liar loans' and 'no doc loans' accounted for 47% of total loans issued last year. At the start of the decade, they were estimated to be less than two percent of total mortgage loans. As a result, homeowners have never been more leveraged: the average amount of debt as a percentage of a property's value has increased to 86.5 percent in 2006 from 78 percent in 2000."

Ok, let's run the math. Almost 50% of the loans made last year were made with little or no documentation check, and 60% of those people overstated their incomes by more than half!!! That means 30% of the loans made were to people who were stretching to buy a home and whose actual income would not qualify them for a home anywhere close to what they bought.

The following chart from RBS Greenwich shows the amount of mortgages hitting the reset button in the next two years.

Research by RBS Greenwich (assuming I read it right) suggests that 20-23% of the subprime loans made in 2006 will go into default and foreclosure. I talked with one head of a mortgage brokerage business in California this week (he has over 800 brokers who work for him) and he thinks that home values in certain areas he services could drop by as much as 50%. Others in my area (Texas) think these defaulting home values will drop by as much as 20%. No one can be sure, as the supply of homes for sale is already very high and likely to get worse.

But let's look at what that can mean for a buyer of a lower-rated tranche of a 2005-6 vintage in a subprime RMBS. If 20% of the loans default and lose 30% of their value, the loan portfolio would be out a total of 6%. If defaults were higher, the losses could be more. 8% would not be a stretch. The problem is that the lower-rated tranches comprise as much as 8% of the total pool.

And that may be optimistic. The study done by RBS Greenwich reads: "Our cumulative default projection would translate to a cumulative loss of 10%-11.5%."

As I showed last week, there are already some 2006-vintage subprime RMBS's that have over 50% of their loans at 60 days past due, with over 25% already in foreclosure or having been repossessed. That is in less than a year, and the interest-rate mortgage resets have not even really kicked in.

Turning Nuclear Waste Into Gold (and Back Again!)

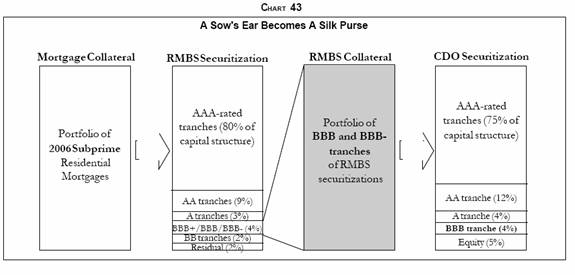

But that's not really where the problem is. Let's go to a great chart from good friend Gary Shilling (www.agaryshilling.com). In an effort to make it easier to sell the lower-rated tranches, the investment banks put together a Collateralized Debt Obligation (CDO) composed of just the BBB-rated paper. And then got the rating agencies to give 75% of that paper an AAA rating! So we have turned 75% of BBB waste into gold with the alchemy of ratings.

That means that if those RMBS lose just 5% of their value, everything but the AAA portion of the CDO is wiped out. Any losses beyond that start eating into the value of what a rating agency said was AAA! If the Greenwich projections are right (and these are very serious analysts), then all 2006-vintage CDO's will lose their AAA rating when the rating agencies look at them again. The new rating becomes "toast."

Who owns this stuff? According to Inside MBS, foreign investors own as much as 16% of the total mortgage securities. Mutual funds have about 16%. Oddly, for all the publicity, hedge funds probably have less than 5%. But they were leveraged, so the losses are magnified.

Mrs. Watanabe and the Hedge Fund Connection

If you live in Japan and are retired, investing in bonds is not all that exciting at rates that are barely 1%. But you can exchange your yen into all sorts of currencies that have investments that pay much higher rates. And of course, that makes the yen go lower, which increases your yield. You notice your neighbor is making very nice returns, and you open a retail currency account and start trading. 25% of Japanese currency trading is from small retail accounts.

If you are a hedge fund, you borrow massive amounts of Japanese yen at 1% and invest in higher-yielding investments and make the spread. Life is good. The trade goes on and on.

Hyman Minsky famously said that stability breeds instability. The longer things are stable, the more likely investors are to become complacent and risk premiums drop. Because of the lower yields, investors tend to over-leverage to try and keep up their returns. The markets are then likely to have a "Minsky Moment" of instability, and then risk premiums rise and all sorts of assets are repriced.

And that is exactly what has happened. The markets are de-leveraging. The yen carry trade is going away, and hedge funds and Mrs. Watanabe are driving the yen back up in as violent a move as I can ever recall. Look at the chart below of the euro-yen cross.

Notice the steady move up in recent months of the euro against the yen, and then a 12% correction in just two weeks! Ouch. Whether it was the Canadian or Aussie dollar, you were down big. And that is forcing a lot of funds to sell anything they can in order to meet margin calls. And since they can't sell their CDOs, they sell stocks, commodities, and anything that is high-quality. That means that assets that do not normally correlate with each now all move together. And the movement is down.

Groundhog Day For Hedge Funds

One of my all-time favorite movies is Groundhog Day, featuring Bill Murray, where the main character keeps living the same day over and over. One hedge fund manager I know in the credit sector says this whole credit cycle has been like Groundhog Day for certain types of hedge funds.

In February some of the lenders began to notice that the credit quality of some of the CDOs they were lending on might not be as good as that rating they had. So they went to the hedge funds and banks and said, "We are not going to offer you as much leverage as before and are going to make you take an extra 5% haircut on those bonds."

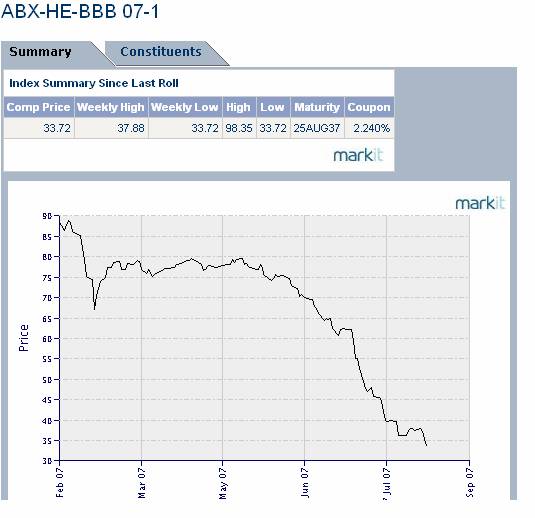

So the funds sold collateral to make the margin calls. And guess what? They had to take less than face value. And that lowered the value of those bonds on everyone's books. Which means the banks went to anyone holding those bonds and demanded more margin money and gave less credit, which created more selling and fewer buyers. The cost of hedging became expensive. It started a vicious cycle. In May, the Bear Stearns fund blew up, and the rout began in full earnest. The chart below is from www.markit.com. You can look at any of the scores of indices they track, and see that the problems began in February.

The above chart is of a BBB RMBS CDO (enough alphabet soup for you?) issued early this year! It is now down to $.33 on the dollar, and it may well go lower. Pools of senior bank loans are selling by as much as a 10% discount. All manner of debt is selling at significant discounts to what it was just 7 months ago.

The problem is, quite bluntly, that no one knows what the values of some of the mortgage-backed securities are. And if you don't know, you don't buy. And today, even very well-designed CDOs with no subprime exposure are selling at discounts, if they are selling at all. Senior bank loans are selling at an apparent discount to subordinated debt (which is not selling, so no one knows the value, so the "price" is the last trade).

And what about the banks that bought those CDOs? What exposure do they have? Are they in a fund or part of the bank capital? Do you want to lend them money on the overnight markets, for a few basis points more than government securities? The commercial paper market for many banks has simply evaporated. These banks depend on this market for their financing.

Last week, the Germans had to completely rescue an older, venerable bank which had a great deal of commercial paper and some off-balance-sheet funds which essentially made the bank's balance sheet negative. If you can't trust a German bank, who can you trust?

This has consequences. As of today, the largest mortgage lender in the US, Countrywide, is now only doing "agency" loans (Fannie Mae and Freddie Mac). Even the best of firms, like Thornburg, are having problems. If you want a nonconforming loan this week to buy a home, either subprime or over $417,000, you may have a very hard time.

The Rating Agency Blame Game

The ratings agencies have put 101 different CDOs on "watch," which is market speak for "we are probably going to change our rating." But that's a little too late.

In 2006, nearly $850 million or 44% (up from 37% in 2002) of Moody's Investors Service total revenue came from the rarefied business known as structured finance. In 1995, its revenue from such transactions was a paltry $50 million. Moody's took in around $3 billion from 2002 through 2006 for rating securities built from loans and other debt pools. The same pattern holds for Standard and Poor's and Fitch.

In short, the ratings agencies were making huge amounts of money from the investment banks for rating these structured products. And let's make no mistake about it, they were selling their name and credibility. Everyone knew what a AAA rating meant when it came to a corporation or a country. And even though there were disclaimers in the 500-page documents accompanying the CDO sales material, the investment banks were clearly pointing to the ratings as they sold that paper.

The entire process hinged on the credibility of the rating agencies. Somehow, no one seemed to think that the default rates from "no-documentation" and "liar" loans would possibly be different. I am sure you can find a paragraph in the offering documents which will make that contention, at least obliquely. Lawyers are good at that stuff. But that is entirely beside the point.

Credit markets function because there is the belief that if you lend money you will get it back. Ratings are the grease for those markets. Now they have become sand in the gears. If you are a bond buyer on an institutional desk, do you want to risk a career-ending move and buy a bond that you are not ABSOLUTELY sure it is what you think it is? Do you want to buy 3-month commercial paper for a few points of spread from a bank or corporation about which you are not 100% sure? Just how solvent is that bank? So, you wait and go to US government bonds in the meantime.

If you are in Europe, you worry about your money market fund. In the US, you think about your CD at Countrywide if it is over $100,000. Everyone gets nervous, and central banks everywhere have to step in and offer massive amounts of liquidity, as they should.

Where Do We Go From Here? Hedge Funds to the Rescue!

This is not the end of the world. I actually think things should sort themselves out by October or so, given no new major surprises. But how do we get back to normal markets?

It might be helpful to look at how we got out of the savings and loan crisis in the late '80s. As everyone now knows, Congress changed the rules and allowed local savings and loan thrifts to finance all types of debt. They jumped in with both feet. Many were very bad at assessing risk and went bankrupt. The government had to step in and bail out the depositors. The assets of the collapsed savings and loans went into the Resolution Trust Corporation (RTC).

I had friends who made a great deal of money in that market. They would walk into the RTC offices. There would be two-foot stacks of manila folders, each folder representing a loan. You could go through the files and then make a bid for the whole stack.

Quite often, in the file there would be checks from good borrowers who kept sending in their check for the car or boat. Since the S&L was gone, there was no one to cash them. People were paying $.15 cents on the dollar for good loans, and working out the rest. Now, some of the loans were indeed 100% write-offs. But a lot were not. But there were so many that the RTC simply took high bid and went on to the next pile.

I also had a friend (whom I have lost touch with) that bought half a dozen older apartment complexes that needed work. He got them for very little cash, put his own work into fixing them up, got them certified as lower-income housing and then got government-guaranteed rent. He was able to retire in a few years.

The same process needs to happen in the credit markets. First, we need someone to step in and actually make a market for the downgraded credits. Who is that going to be? Mutual funds? Investment banks? The Fed? No, no, and no.

The answer is that it will largely be distressed-debt hedge funds, both those that exist today and the scores that are being formed as I write. There are bonds and loans, various CDO securities, CLO funds, etc. that are seriously mispriced because of the lack of liquidity and transparency. When you can buy a loan today for $.94 that has a 99.9% chance of being good, you simply take the interest and get the extra return for allowing the loan to go back to par. Even modest leverage produces very nice returns.

Savvy distressed-debt managers will go in, look at the paper, and buy it. This time, instead of manila folders it will be electronic files. But with a lot of work, someone will be able to assess the value. Of course, the bad paper needs to be written down and off the books. There will be little appetite for a lot of the riskier paper.

Also, the structure of many CLOs will help. Most CLOs are formed and have a finite life. But for the first 5-7 years, they take the principal repayments and reinvest those dollars in other loans. CLOs that are getting cash today are finding good values.

Warren Buffett Needs to Take Over Moody's

Second, the rating agencies need to restore their credibility. Warren Buffett's Berkshire Hathaway owns about 19% of Moody's. I would suggest that Mr. Buffett step in take over the company (much as he did with Salomon years ago) and put his not inconsiderable credibility on the line for all future ratings and the inevitable re-ratings that are going to be done.

The Panic of 1907 was solved by the credibility of one man, J. P. Morgan, who stepped in to provide liquidity. The Panic of 2007 is not a problem caused by lack of liquidity. It is a problem caused by lack of credibility. Morgan could (and did) provide liquidity. Buffett can (and should) provide credibility.

And someone of similar stature needs to step in at S&P and Fitch. (Can Volker be summoned into the trenches yet one more time?) This is not about whether some person or group at the ratings agencies necessarily did anything wrong, although more than a few lawyers will suggest just that. This is about restoring credibility to the ratings and markets as soon as possible. Without someone new at the head, future ratings are likely to be viewed with the skeptical (and correct) question, "Is this from the same group of people who rated that bond that I bought just a few months ago that is down 50%? Why are they right now? Where is the adult supervision? Who has made sure the process is now working?"

The SEC has announced that they will allow mortgage lenders to work out resetting mortgages with borrowers in cases where there is an obvious default about to happen. In many cases, that will mean extending the lower coupon rate another year. That may just put off the problem, but it will keep a home off the market and allow for a more orderly solution.

Will a Fed Rate Cut Make a Difference?

A rate cut will not make a difference as to the credibility of the ratings, nor will it transform bad debts into good ones. But my view has been for a year that the economy is heading for a recession due to the housing market problems. Given the turmoil in the markets, a rate cut may be in the offing later this year. And given that lower rates will make mortgages cost less, that will help.

The significance of today's cut of the discount rate, and the willingness to look at up to 30 days of loans and high-quality asset-backed paper, is not the actual cut but more the boost to confidence. It is the Fed saying to the market, "Daddy's home. Everything is going to be all right."

Beyond that, let's look at what Nouriel Roubini says today in his blog about the Fed move to cut the discount rate:

"More important than the symbolic 50 basis point cut in the discount rate was the move in today's FOMC statement from the semi-neutral bias of the last few months ('semi' as inflation was still their predominant concern until recently) to a clear easing bias today. Essentially today the Fed telegraphed a certain Fed Funds rate cut at the September meeting and possibly more cuts in the months ahead.

"The statement was very clear in signaling an easing bias and a policy cut ahead: 'Financial market conditions have deteriorated, and tighter credit conditions and increased uncertainty have the potential to restrain economic growth forward. The statement also pointed that 'the downside risks to growth have increased appreciably.' And it clearly signaled that the FOMC is 'prepared to act as needed to mitigate the adverse effects on the economy arising from the disruptions in financial markets.'

"The stress on the downside risks to growth and the failure of the statement to even mention the 'I' word (Inflation) suggests that, in about a week since the previous FOMC meeting, concerns about inflations as the predominant risk have faded and concerns about growth have sharply increased. For a Fed that until recently was in the soft landing camp (slowdown of growth but still moderate pace of growth) today's statement is a signal that they are starting to worry about a hard landing of the economy.

"For the first time in over a year the Fed is now implicitly admitting that they underestimated the downside growth risk: until now the official Fed view was that the housing recession was contained and bottoming out and not spilling over to other sectors of the economy; and that the sub-prime problems were also a niche and contained problem. The sudden shift to a strong easing bias suggests that the Fed miscalculated until now the damage to the economy and to financial markets of the housing recession and its real and financial spillovers."

While I am not so sure that the Fed will cut in September, they have signaled that they are aware of the problems, as noted above.

As an answer to my opening question, I think we are in for a return of the Muddle Through Economy rather than the End of the World. Credit markets will get back to normal, as there is a lot of money that needs to find a home. It is just looking for a credible home and one that will feature higher risk premiums and spreads.

John Mauldin is president of Millennium Wave Advisors, LLC, a registered investment advisor. Contact John at John@FrontlineThoughts.com.

Disclaimer

John Mauldin is president of Millennium Wave Advisors, LLC, a registered investment advisor. All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors before making any investment decisions.

|

|