- Market: May 2006 Cotton (CTK6)

- Tick value: 1 point = $5.00

- Option Expiration: 04/13/06

- Trade Description: Bull Call Ladder Spread

- Max Risk: $250

- Max Profit: $750

- Risk Reward ratio: 3:1

Buy one May 2006 Cotton 55 call, buy one May Cotton 60 call, while selling one May Cotton 57 call, and sell one May Cotton 58 call. For a combined cost and risk of 50 points ($250) or less to open a position.

Technical/Fundamental Explanation

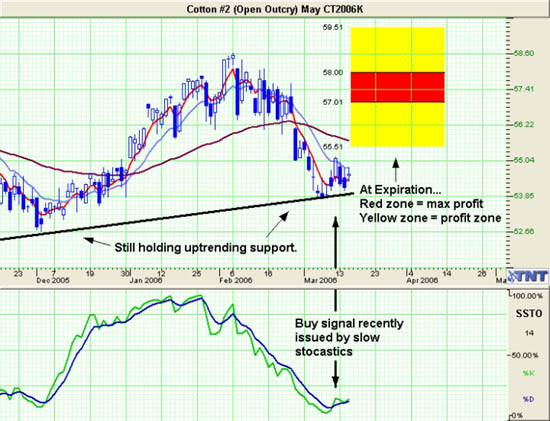

The cotton market has seen quite a roller coaster ride for most of the last year. As you can see on the chart below we have just recently bounced off of trend line support. Fundamental support lies at or near 54 on the May contract. At that level chinese buyers have been "seen" buying with both hands. As China continues to modernize, demand for cotton will increase with it. Now that energy prices continue to be high cotton is almost "cheaper" than polyester which is cottons main rival fabric, and it is of course made from oil. Cotton and Crude Oil have always had a substitutive relationship based on price. Near term we see some weather factors that could begin a rally as well as renewed fund interest in the coming weeks. This is a low cost bull trade that has a very large range in which we can profit.

Profit Goal

Max profit assuming a 50 point fill is 150 points ($750) giving this trade a 3:1 risk reward ratio. Max profit occurs at expiration with Cotton trading between 57 and 58. The trade is also profitable at expiration if the Cotton is trading any where between 55.50 and 59.50 (break even points) which means we have a band of 400 points in Cotton that we can profit in.

Risk Analysis

Max risk assuming a 50 point fill is $250. This occurs at expiration with the Cotton trading below 55 or above 60.

Disclaimer

Past performance is not indicative of future results. Trading futures and options is not suitable for everyone. There is a substantial risk of loss in trading futures and options.

Matt Odom is the Managing Partner and Energy Analyst and Derek Frey is Head Trader at Odom & Frey Futures & Options.